Large domestic pharmaceutical companies are likely to continue their growth pattern as they increased sales in the second quarter despite slight drops from the first three months.

Hanmi Pharmaceutical, Daewoong Pharmaceutical, Samsung Biologics, GC Pharma, and Hanmi Pharmaceutical began to release their reports Friday.

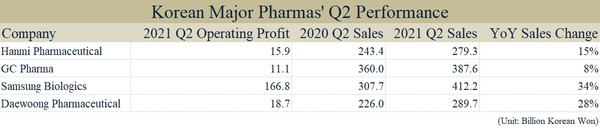

Samsung Biologics achieved its highest quarterly performance in the second quarter, recording 412.2 billion won ($358 million) in sales and 166.8 billion won in operating profit.

Its sales increased by 104.5 billion won, or 34.0 percent, from the same period of last thanks to the operation of its third plant for manufacturing new drugs and the impact of the Covid-19 product sales. The company’s operating profit also soared 105.7 percent to 85.7 billion won over the period.

“We plan to focus on operating our manufacturing facilities more efficiently and receiving pre-orders for the fourth plant,” a Samsung Biologics official said. “We will also try out best to end the Covid-19 pandemic through a stable and rapid supply of Covid-19 vaccines and treatments.”

GC Pharma’s consolidated revenue in the second quarter reached 387.6 billion won, up 7.7 percent from a year ago, thanks to its vaccine business.

The company filled the void caused by the termination of contracts for the domestic supply of global pharmaceuticals’ vaccines with global vaccine businesses and expanding domestic prescription drug sales.

GC Pharma’s overseas sales of its flagship vaccine products reached 61.4 billion won, up 61.3 percent.

“There are variations in quarterly sales and expenses. On an annual basis, however, we anticipate an improvement in earnings as expected early this year,” a company official said,

Daewoong Pharmaceutical hit the highest quarterly record ever. Sales rose 14.1 percent year-on-year to 289.7 billion won. At the same time, operating profit and net profit turned to the black-ink figures of 18.7 billion won and 9 billion won, respectively.

In particular, the sales of Nabota, a botulinum toxin formulation, recorded an earnings surprise, and ETC recorded the highest sales of nearly 200 billion won.

Daewoong also benefited from licensing out its technology of novel therapy Fexuprazan for gastroesophageal reflux disease. The 11.1 billion won royalty payment was reflected in the consolidated revenue.

“Our BTX Nabota has entered the Chinese market following approval received in the U.S. and Europe,” Daewoong Pharmaceutical CEO Jeon Seng-ho said. “We will maximize shareholder value through research and development (R&D) as we carry various novel pipelines such as Fexuprazan, diabetes drug Enavogliflozin (DWP16001), pulmonary fibrosis therapy DWN12088, and autoimmune disease treatments.”

Hanmi Pharmaceutical recorded sales of 279.3 billion won, operating profit of 15.9 billion won, and net income of 8.3 billion won in the second quarter.

The company explained it has invested 38.6 billion won, 13.8 percent of its sales, in R&D. Compared to the same period of the previous year, sales increased by 14.7 percent. Its operating profit and net profit also jumped 49.6 percent and 43.1 percent.

Hanmi said the stable prescription sales of independently developed products and the explosive growth of Beijing Hanmi Pharm, a subsidiary in China, drove such good results.

In addition, it took top place in the domestic outpatient prescription market in the first half of the year, maintaining the position for three years since 2018.

“Hanmi Pharmaceutical plan to continue its sustainable management of R&D for novel drugs and solid growth of improved and complex drugs, stable performance of subsidiaries and innovation,” Hanmi Pharmaceutical CEO Woo Jong-soo said.