The first product to gain indications for a disease often maintains a dominant position in the market for years. This is not so for Boehringer Ingelheim’s novel oral anticoagulant (NOAC) in Korea.

There are currently four NOAC treatments developed by Boehringer Ingelheim, J&J-Bayer, BMS-Pfizer, and Daiichi-Sankyo, respectively.

These treatments have been hailed as the new form of therapy for non-valvular atrial fibrillation (NVAF) patients where vitamin-K antagonists such as warfarin were the standard care for the past couple of years. These drugs have allegedly decreased the risk of congestive heart failure, coronary disease, and peripheral vascular disease, according to Pfizer Korea.

■ Related : ‘Korean version of NOAC guidelines may come out before long’

According to the British Journal of Clinical Pharmacology, NOAC treatments accounted for around 56.5 percent of NVAF treatment prescriptions, a 58 percent increase over the study period from 2009-2015. The market has seen an even greater increase from 2012 onwards, indicated by a 17 fold increase from 2012 to 2015, the journal said.

There are currently four players in the domestic NOAC market: J&J-Bayer’s Xarelto was the first drug to be launched in Korea, but Boehringer’s Pradaxa was the first to gain indications to treat NVAF. Following Pradaxa, Xarelto and Pfizer-BMS’ Eliquis earned the same indication in successive order two years ago with Daiichi Sankyo’s Lixiana winning it last year.

However, despite being the first NOAC treatment for NVAF patients, Boehringer’s Pradaxa has seen falling prescription numbers with fast followers rapidly gaining market share, according to data from UBIST.

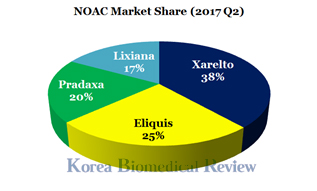

Current statistics show J&J-Bayer’s Xarelto holding the leading position with a 38 percent market share regarding prescription numbers, followed by Pfizer-BMS’ Eliquis at 25 percent, Boehringer Ingelheim’s Pradaxa at 20 percent and Daiichi Sankyo’s Lixiana (also known as Davaysa in the U.S.) at 17 percent.

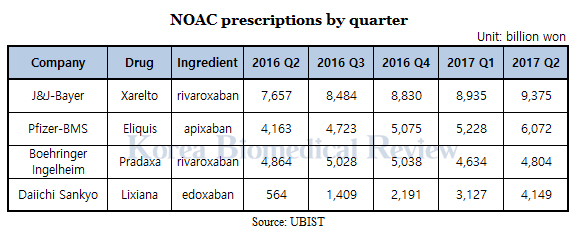

Prescription data from UBIST shows J&J and Bayer’s Xarelto has so far gained market dominance, recording approximately 9.3 billion won ($8.2 million) in the second quarter alone, a 22 percent increase from the same period last year.

Pfizer and BMS’ Eliquis - despite entering the market later - is rapidly catching up to Xarelto seeing a 45 percent increase over a year and ending with around 6 billion won in second-quarter prescriptions.

Daiichi Sankyo’s Davasya showed the most explosive growth despite being the last entrant, recording 564 million won prescriptions in the second quarter of last year and 3.1 billion won in the first quarter of this year – a 600 percent increase.

Boehringer Ingelheim has seen fluctuating sales and ultimately ended with no difference over a year. The company had recorded 4.8 billion of prescription sales in the second quarter of last year and the same a year later.

Industry experts are looking out for which company will come out on top and if there will be a clear market leader in a relatively optimistic market, albeit riddled with side effects.

■ Related : Anticoagulant drugs will add SJS Warning

Most NOACs have reported side effects regarding dosage. Too little, and the medication becomes ineffective. Too much, and the patient risks the possibility of internal bleeding and other complications. In the U.S., Xarelto, and Pradaxa both face thousands of lawsuits regarding their NOAC drugs causing bleeding, and Pfizer-BMS is confronted with a couple hundred as well.

These pharmaceuticals, in turn, have pushed back with clinical data that shows the safety of these drugs in comparison to warfarin. However, it is notable that in the Pfizer-BMS trials, there were two deaths in the Eliquis group and one in the standard of care group, leaving the question of how effective NOACS are, up in the air.

■ Related : BMS, Pfizer prove safety for blood-thinning drug in P4 trial

For now, J&J-Bayer leads the pack with Pfizer-BMS and Daiichi Sankyo showing growth.