What does hair loss treatment Propecia, cholesterol therapy Lipitor, and hepatitis B drug Viread have in common?

All four are the leading products in their respective field even though hundreds of generics exist.

Industry practice dictates the price of an original product be set at 70 percent of its original cost for 12 months after the first generic is launched. After 12 months, the rate is set to 53.55 percent of the original price.

With the government policy and the flooding of generics, sales of original drugs often fall steeply following patent expiration.

However, this was not the case for Propecia, Lipitor, and Viread that still maintain market dominance. The small difference in price and quality between the original and the generic often plays a significant role, a local expert said.

“From the perspective of the patient or doctor, there’s no significant benefit from switching to a generic drug. There’s also no notable difference in price or quality. To put it simply, the patient has no merit in switching to a generic,” said an industry insider who claimed anonymity.

Lower prices for the original drug as well as patient and physician preference for the original are the main reasons why these drugs have maintained high sales after patent expiration.

The phenomenon was most notable in the chronic disease therapy market for cholesterol, hepatitis B, and hair loss.

Sales of Pfizer’s Lipitor (ingredient: atorvastatin) increased continually despite 115 copycat drugs entering the cholesterol market following its patent expiration in 2009.

According to UBIST data, Lipitor recorded 80 billion won ($74.4 million) in sales in 2008, before patent expiration. After a small dip in sales in 2012 due to the mandated price cut, Lipitor sales took a steady upward trend, a Pfizer official said.

Last year, Lipitor recorded 156.6 billion won ($145.1 million) in sales, indicating a 50 percent jump in nearly 10 years.

Experts have pointed to an increasing number of hyperlipidemia patients and the small price gap between Lipitor and generics as the main reasons for its market dominance.

Pfizer also noted that it has also continually published up-to-date safety and efficacy data on Korean patient while increasing patient convenience.

“Pfizer continued to reaffirm the effectiveness and value of Lipitor through various studies even after the patents expired. Particularly, we focused on proving the effectiveness of the therapy on Korean patients through various studies on Korean subjects,” a Pfizer Korea official said. “We've also reduced the size of the pills to enhance patient compliance.”

Gilead Sciences’ Viread for hepatitis B recorded the highest sales among all prescription drugs last year with prescription sales of 166 billion won, marking an almost 8 percent jump from the previous year.

■ Related: Gilead Sciences’ Viread recorded highest prescription sales in Korea last year

The hepatitis B therapy made its debut in the Korean market in 2012. Its patent expired in November last year, opening the way for Korean pharmaceutical firms to launch generics.

Despite the patent expiration, UBIST data showed Viread maintained its number one spot among prescription drugs with sales of 39.3 billion won in the first quarter of this year.

According to a Gilead Sciences Korea official, Viread is preferred by both physicians and patients because it can be used to treat a large number of patients who have grown immune to hepatitis therapies.

“Many patients have developed a tolerance to hepatitis B treatment in Korea. Viread, with its strong antiviral effect and high immune barrier, can be used to treat patients early and has demonstrated sufficient virus inhibiting effect as a salvage therapy on patients who have developed immunity,” said an official at Gilead Sciences Korea.

Long-term treatment with Viread has also shown to improve hepatic fibrosis and improve histologic cirrhosis of chronic hepatitis B virus, the official added.

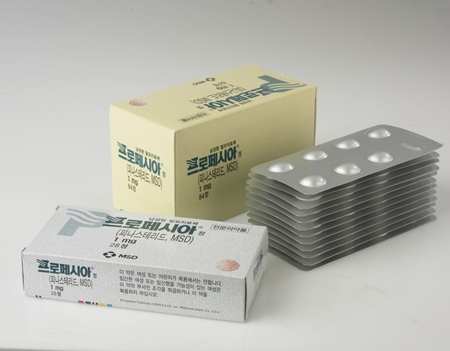

Propecia (ingredient: finasteride) sales have also ranked far and above the sales of similar products such as GSK’s Avodart, JW Shinyak's Monad, and Hanmi Pharmaceutical’s Finated. The drug developed by MSD entered the Korean market in 2000, and the drug’s patent expired in 2009.

Despite more than 30 generic products flooding the market after patent expiration, Propecia sales hit 39.7 billion won last year, which was more than double of the 15.7 billion won recorded in 2006. In contrast, the sales of competitor products remained below the average of 5 billion won ($4.6 million) in 2014.

These numbers are surprising considering that Propecia, unlike Viread or Lipitor, maintains a high price because it is not reimbursed by the health insurance fund and therefore not subject to the mandated price cut. Reimbursement applies to medical products excluding cosmetic or beauty ones.

According to MSD Korea, Propecia was able to maintain its lead due to its brand power that comes from superior product quality and a growing hair loss therapy market.

“Propecia was able to maintain number one sales and a dominating market share of 60 percent based on its superior efficacy and safety even after more than 30 generics were launched in the market,” an MSD Korea official said.

Propecia was able to maintain a continual sales growth even after patent expiration thanks to the expansion of the hair loss therapy market and its superior product quality, the official added.