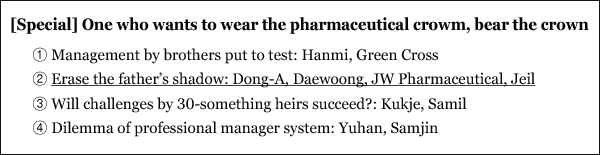

Unkind environment awaits new CEOs beginning to stand alone

Chairman Kang Jung-seok of Dong-A Socio Group; deep shade of ‘godfather’ and owner risk

In January, the Dong-A Socio Group동아쏘시오 그룹opened the “era of Chairman Kang Jung-seok강정석.” Former Chairman Kang Shin-ho강신호, who had led the company for a long time, retired and became an honorary chairman, handing over his position to his son Jung-seok. The change at the top has also led to the lump-sum replacement of the CEOs of group subsidiaries with younger managers, opening a new chapter of Dong-A Socio Group under the stewardship of Kang Jung-seok.

The new chairman, the fourth son of the old one, entered Dong-A Pharm동아제약 in 1989, and received managerial training for a long time, serving as head of management control office, medical business headquarters, CEO of Dong-A Otsuka동아오츠카, vice president of Dong-A Pharm, and vice chairman and CEO of Dong-A Socio Holdings동아쏘시오홀딩스.

Many industry watchers, however, say the junior Kang has “not escaped from his father’s shadow entirely,” given the influence the former chairman still exerts on the Dong-A Socio Group.

Honorary chairman Kang succeeded to the late founder Kang Joong-hee강중희 and led the group for 35 years, making its flagship unit, Dong-A Pharm, synonymous to Korea’s No. 1 pharmaceutical company. He has he made remarkable accomplishments in pharmaceutical industry, including the creation of the energy drink “Bacchus legend” and the first establishment of in-house research lab among Korean drugmakers. The senior Kang has also left giant footprints on the nation’s business history by serving as the chairman of the Federation of Korean Industries, the lobby group for family-controlled conglomerates. As he had been quite active on various official occasions, many still recall the senior Kang when they hear Dong-A Socip Group.

Fathers’ shadow is both strong support for successors and a mountain to cross. For Kang Jung-seok, who has to demonstrate his management ability to people in and outside of the company, his father’s existence is more likely to serve as the latter.

Circumstances surrounding the group are not easy, though.

To begin with, there is a rebate scandal concerning the video lecture in 2013, and the group has yet to improve relationship with the medical sector, aggravated by its delayed submission of data to verify the efficacy of its gastritis treatment Stillen Tab, when taken as non-steroidal anti-inflammatory drugs (NSAIDs) injection to prevent gastritis. In the process, Stillen’s sale plunged from 90 billion won ($79 million) to 20 billion won ($17 million). Also, the company has several ticking bombs, including the illegal distribution of growth hormone injection by one of its salespeople in Busan last year, suspicion about the illegal lobby of an official at Health Insurance Review and Assessment Service early this year, and prosecutor’s raid concerning their probes into a suspected rebate case.

Also on the negative watch list is “owner risk.” The group has a good social image thanks in part to Bacchus drink, which both advertises Dong-A products and represents its corporate image, and its walking-across-the-country campaigns. The new chairman, however, tarnished part of the good image when he destroyed the laptop computer of a parking lot official enraged by the latter’s issuing of a ticket in 2015. Worse yet, that coincided with the period when public sentiments against chaebol were not good because of these wealthy families’ high-handedness.

Chairman Yoon Jae-seung of Daewoong Pharm has solidified his heirship; what about his leadership, however?

Chairman Yoon Jae-seung윤재승 of Daewoong Pharmaceutical대웅제약 has experienced ups and downs as a successor.

Yoon graduated from the Seoul National University’s Department of Law in 1985, passed the 26th bar examination, and served as a prosecutor at Seoul District Prosecutors’ Office for three years until 1995.

He took the first managerial position in 1997 and led the company for 12 years, but lost his control to his brother, Vice Chairman Yoon Jae-hoon윤재훈 in 2009, as his father and former chairman, Yoon Young-hwan윤영환, made his elder son to take full charge of the company. But the elder son stepped down three years later, taking responsibility for worsening management, and Yoon Jae-seung restored managerial control by being reappointed as the CEO of Daewoong Pharmaceutical in 2012.

Now, the elder son and former vice chairman is managing RO Corp., which was spun off from the Daewoong Group last year, and the new chairman has garnered sufficient equity stakes, leaving little room for further management disputes.

Yoon Jae-seung had managed Daewoong Pharm for a long time, but it was 2014 that people recognized him as the indisputable heir of his father. It was in that year when former Chairman Yoon Young-hwan receded to honorary chairman and picked his younger son as the new chairman. The senior Yoon contributed all his stakes to an in-house foundation, buttressing his successor further.

The new chairman also began to improve the corporate physique of Daewoong by taking the lead in advancing to overseas markets and reforming internal operations. The company released the botulinum drug Nabota and high blood pressure complex Olostar in 2014 and pushed for oversea advancement to the United States and Southeast Asia after strengthening its overseas business department.

Some point out the leadership of Yoon Jae-seung is faltering, however. The company handed over rights to sell Januvia, Atozet, Vytorin, and Gliatilin, which had long been the most profitable products, to Chong Kun Dang Pharmaceutical last year. Also, it was at the center of controversy over the source of the strain of the botulinum drug Navota, with Medytoxm, the first Korean company to commercialize botulinum toxin strain, just when Daewoong tried to enter the U.S. market with the Botox product. The dispute is still going on.

There were gossips, too, over personnel appointment.

In 2015, Daewoong Pharm removed a hierarchy system and used the honorific of “nim” at the end of a name when employees called each other. And it conducted extraordinary personnel reshuffles by naming young executives in their 30s and 40s to major positions. The company said the appointments were aimed to give roles by ability, but some criticized it wasn’t appropriate to appoint inexperienced, young managers to divisions that require expertise. A number of “Daewoong people,” who had worked at the company for long, move to its competitors at the time, generating a lot of buzz in the pharmaceutical industry.

Yoon’s recruitment of Yang Byung-guk양병국, former head of the Korea Center for Disease Control and Prevention (KCDC), as the CEO of Daewoong Bio대웅바이오 also raised some stirs. A civic group took issue with the appointment, saying Yang’s recruitment caused a conflict of interest problems, and the company underwent an investigation by the Government Public Ethic Committee.

The ever-worsening business performance also came as a burden. Sales and operating profits last year declined 0.81 percent and 35.74 percent, respectively, from 2015 to 794 billion won and 35.3 billion won.

Chairman Lee Kyung-ha of JW Group; is there synergy with professional managers?

Chairman Lee Kyung-ha이경하 took the JW Group’s JW그룹 highest post in 2015, beginning the third-generation management system in earnest.

Chairman Lee, the grandson of the founder Lee Ki-seok이기석 and the oldest son of honorary chairman Lee Jong-ho이종호, joined JW PharmaceuticalJW중외제약 as soon as he graduated the Sungkyunkwan University College of Pharmacy in 1986. Unlike other successors of drugmakers, he worked as a salesman at a provincial office before he became the marketing manager at JW Pharmaceutical in 1996. Afterward, Lee served as the CEO of C&C Research Laboratories C&C신약연구소, and vice president of JW HoldingsJW홀딩스 and CEO of JW Pharmaceutical. He became the chairman in 2015, 30 years after he joined the company and six years after he became its vice president, opening the third-generation management system in earnest.

The industry regards Lee as a manager who focuses on stable operation rather than introducing massive innovation, given that he, unlike most other successors, has worked in marketing frontlines and received managerial training for more than 30 years.

Chairman Lee Kyung-ha has to tackle the task of stagnant growth, however. Industry watchers point to the construction of a factory to produce fluid in Dangjin, South Chungcheong Province, which began in 2008, as one of the factors behind the company’s growth. The fluid has led JW’s growth and is still one of its principal products, but its profit ratio is not higher compared with other products. JW Pharmaceutical invested about 300 billion won in the factory, but its sale has stood still since it reached 455.1 billion won in 2009. But there have been some signs of change recently, including the conclusion of large-scale export contracts with SKK Japan and the U.S. in 2013, and the listing on the KOSPI stock market of JW Life ScienceJW생명과학, which exclusively produces fluids.

Also noteworthy is the fact that Chairman Lee resigned from the CEO post of JW Pharmaceutical in the shareholders’ meeting. The company changed from the co-CEO system of Lee Kyung-ha and Han Sung-kweon to that of Han Sung-kweon and Shin Young-seop, and Lee decided to retain only the chairmanship of JW Holdings.

Only, there seems to be an apparent limit to the company’s further growth – the lack of products that can spearhead its expansion. It has strengthened drug portfolio led by the endocrine series, including Guardlet, Gadmet, Livaro, and Livaro V, but has yet to produce satisfactory results. That is due to many competing products, but the company hasn’t shown a notably differentiated strategy.

Another weakness is its poor R&D pipelines. The company expects “CWP291,” a target anticancer therapy to inhibit Wnt/β-catenin mechanism related to the growth of cancer cells and cancer stem cells, will emerge as a successful drug but will have to overcome obstacles in the way to its commercialization.

Chairman Lee, well aware of the need to secure pipelines, made public the outcomes of C&C Research Laboratories C&C신약연구소, a joint company set up in partnership with Japan’s Chugai Pharmaceutical쥬가이제약 in September 2016. The lab has eight pipelines, including pre-trial anticancer therapy and immunological disease therapy

How good is the management ability of Han Sang-cheol, vice president of Jeil Pharmaceutical, which has long remained in secret?

Jeil Pharmaceutical제일약품 will transform itself into a holding company in June, and Vice President Han Sang-chul will take its full charge by then, as a third-generation manager.

Han, now in his early 40s, is the grandson of the late founder Han Won-seok한원석 and the oldest son of Chairman Han Seung-soo한승수. Chairman Han has been away from the managerial front since 2011, but Jeil Pharmaceutical has been cautious to confirm the handover of managerial control to its vice president.

According to the recent business report released by the company, however, Vice President Han has been named as the president of Jeil Pharm Holdings제일파마홀딩스 while retaining his current post of the vice president of Jeil Pharmaceutical. He is also the CEO of Jeil Health Science제일헬스사이언스, which has been spun off to deal with general medication business. All this shows Han’s succession is inevitable.

Han graduated from Yonsei University as an industrial engineering major in 1976, and also graduated business school at University of Rochester. He joined Jeil Pharmaceutical in 2007 and served as a director of its marketing headquarters, executive director in charge of the management planning office, and vice present to handle overall management. Since 2011, he has been the executive director of the management planning office to take part in management in earnest.

Jeil Pharmaceutical will be split into Jeil Pharma Holdings and New Jeil Pharmaceutical신제일약품 in June and become a group to also include Jeil Health Science and Jeil & Partners제일앤파트너스. Vice President Han Sang-chul’s equity stake is still small, remaining at only 4.66 percent, compared with his father’s 27.31 percent. Together, the family’s equity stake totals 45.99 percent, enough to push for the company’s conversion into a holding company.

Although Han has made a stepping stone to the takeover of managerial control through the conversion, he has a lot of problems to tackle. One of Jeil’s chronic problems is sales from proxy selling is larger than the sales of its products. It remains to be seen how he would cope with such criticism.

According to the business report of Jeil Pharmaceutical released last month, 70.13 percent of its sales came mostly from imported drugs, such as Lipitpr Tab, Lyrica Cap and Celebrex Cap made by Pfizer, and other pharmaceuticals. Jeil’s R&D investment accounts for only 3.62 percent of its turnover. Jeil Pharmaceutical was one of Korea’s 10 drugmakers in sales amount but wasn’t on the list of 37 innovative pharmaceutical companies. Accordingly, industry watchers jeer at the company, saying it is lazy in developing new drugs bent on only selling products produced by other firms. The company is developing stroke therapy, anticancer therapy, and pain therapy, but it is too early to predict their successes.

The first indicator of Han’s managerial ability must be the general medication area because Sung Seok-je성석제, CEO of Jeil Pharma, is in charge of prescription drug field as a professional manager. As Han is the chief executive officer of Jeil Health Science, he has to seek a turnaround in relatively sluggish general medication area. And this explains why performance report of its hit item, Kefentech, is drawing the industry’s attention.

In the long run, it also depends on Han how he would make the most of the “solid partnership” with Pfizer Korea Sung has built, and whether he can make Jeil a company that can move beyond reselling business toward a “firm that makes (develops) drugs,”