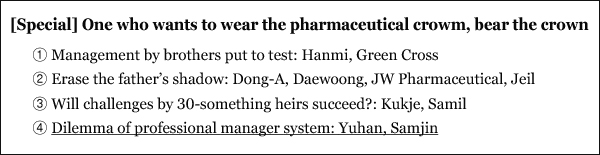

Small R&D spending despite continuous growth emerges as task to tackle

Free from owner’s influence, CEO Lee Jung-hee of Yuhan Corp. struggles under pressure for sales growth

Yuhan Corporation유한양행 means a lot in Korea’s pharmaceutical industry. It is the first pharmaceutical company that hit the landmark sales of 1 trillion won ($8.8 billion) in 2014, and also is one of the few drugmakers that adopt the professional manager system.

The late founder Yoo Il-han 유일한 kicked out his son, who once served as Yuhan’s vice president, and even his nephew from the company, saying they could hamper its growth. Since then, professional managers have run Yuhan.

That in part explains why pharmaceutical workers call Yuhan a dream company where mere clerks can rise up to the CEO post to “create a legend.” Actually, Yuhan has appointed CEOs among vice presidents promoted from rank-and-file employees. Ex-President Kim Yoon-Seop 김윤섭, who opened the era of 1 trillion won ($1 billion) in sales, and current President Lee Jung-hee이정희 rose to CEO posts starting as low men on the totem pole.

Yuhan CEOs’ tenure is three years, and they can serve up to six years by being reelected at shareholders’ meeting. The company reportedly picks next CEOs from among vice presidents after verifying their abilities.

CEO Lee, who took the current post in 2015, graduated from Yeungnam University as an English literature major. He joined the company as an ordinary employee in 1978 and worked at the hospital business department, distribution business department and marketing & PR department. He later served as the chief of management control department, executive director, and vice president before becoming its chief executive officer.

It is true the top managers of Yuhan Corp. are relatively less conscious of the owning family, but that does not necessarily mean they are entirely free from burdens. Rather, the maximum tenure of six years comes as pressure for bolstering sales. CEO Lee faced criticism of sales structure when he took office. Critics attributed Lee’s attainment of his sales target of 1 trillion won to the marketing of other companies’ products, not the development of its products while pointing out that the firm was relatively negligent in research and development.

Yuhan’s sales had sharply risen thanks to its marketing of a series of hit products in a business tie-up with multinational pharmaceuticals, including Boehringer Ingelheim베링거인겔하임. Among such products are antidiabetics therapy Trajenta, anticoagulant Pradaxa, high blood pressure therapy Twynsta, hepatitis B therapy Viread, and pneumococcus vaccine Prevenar. The company reaffirmed its strong position in pharmaceutical business through their marketing by attaining the 1 trillion won sales landmark. But some within the industry were sarcastic, calling Yuhan a “distribution company.”

The company’s sales report in 2014 shows four imported drugs -- Viread, Trajenta, Twynsta, and Prevenar – accounted for 28.4 percent of the total. Given that the sales from Yuhan’s prescription drugs represented 62.6 percent of the total, imported products took up half of its sales.

The situation was not much different last year. According to its business report made public this year, the portions of imported and prescription drugs were 28.6 percent and 63.4 percent, respectively. Considering there are undisclosed imported medicines, the share of sales generated by marketing other companies’ drugs increases further.

Yuhan’s R&D investment is not small compared with other businesses regarding the total amount. The company invested 86.5 billion won into R&D last year. The figure, however, leaves much to be desired, given some of its competitors, such as Hanmi Pharm한미약품 and LG Life Sciences at LG ChemicalLG화학, spent 100 billion won a year on research and development. Yuhan R&D expenditure against sales was 6.5 percent, a rather stingy level for Korea’s No.1 pharmaceutical company.

There are some positive sides, too, however, such as its sharp competitive edge in the area of Active Pharmaceutical Ingredient (API), and the company’s significant investment in R&D over the past couple of years. The company has more than redoubled its pipelines by recruiting Nam Soo-yeon 남수연, who had experiences of developing new drugs for BMS and other businesses, as the chief of its research lab, and focused on the development of complex treatments, too.

The company released high blood pressure complex Duowell and Rosuvamibe after developing them with its technology in 2014 and is currently developing YHP1604 by combining Twynsta complex YH22162 with hyperlipidemia therapy Rosuvastatin. The Phase 3 clinical trials for the incrementally modified Pregabalin drug YHD1119 is also underway. Moreover, Yuhan is developing the targeted therapy of non-small cell lung cancer YH25448 and jumped into the development of anticancer immune therapy by establishing a joint company.

One can call it an accomplishment that Yuhan has made significant growth with imported medicines. It is also true, however, such performances fall short of meeting its name value and popular expectations. And these are some of the knots that Yuhan has to untie, as one of the two pharmaceutical companies that have gotten rid of the owners’ management and the nation’s top drugmaker in sales.

Samjin Pharm President Lee Sung-woo, the longest-serving CEO, hides strength behind soft leadership

Samjin Pharm삼진제약 has drawn the industry’s attention by establishing the professional management system in different ways from Yuhan Corp. It has been 49 years since co-chairmen Choi Sung-ju최승주 and Cho Eui-hwan조의환 founded the company. Their sons are working at the company, but haven’t taken part in its management.

It is CEO Lee Sung-woo 이성우 who is leading the company. He first became its CEO in 2001 and was reelected at last year’s shareholder meeting for six consecutive terms to position himself as the longest-serving CEO in Korea Lee is winning high trust from people in and outside of his company, including its co-founders, by registering continuous sales growth amid no labor disturbances.

CEO Lee graduated from Chung-Ang University College of Pharmacy and entered Samjin Pharm in 1974. He took key posts in its sales department, including executive director and vice president. After becoming the CEO, he proved his ability by making a series of big hits with blockbuster prescription drugs to treat elderly patients’ chronic diseases, such as Platless, Neutoin, and Newstatin A.

Samjin Pharm’s annual sales, which stood in the 40 billion-won ($35.3- million) range when Lee first took office, grew nearly six times to 239.3 billion won last year. Lee demonstrated his ability particularly in 2015 when the domestic business was reeling from a severe slump because of Middle East Respiratory Syndrome and other reasons. In that year, he registered sales of 216.5 billion won, up 7.6 percent from the previous year, operating profit of 36 billion won, up 13.9 percent, and the net profit of 27 billion won, up 30.5 percent. Samjin maintained its growth pace last year, registering the operating profit of 42 billion won and the net profit of 30.1 billion won.

It is also actively investing in research and development, sparing no expense to synthesize raw materials as well as developing new drugs. A case in point is antithrombotic Platless Tab. The drug, which first hit the stores in 2007, had become one of the company’s big moneymakers, garnering sales of 48 billion won as of 2016.

In 2009, Samjin succeeded to synthesize the raw material of micro-bead type hydrosulfide cesium Clopidogrel through research and development of the synthesis of Platless, for the first time among Korean pharmaceutical companies. Samjin is still the only Korean company to synthesize the raw material of raw materials independently. With such a success, the company has not only won recognition for its technological superiority but managed to cut costs because it does not need to use imported materials. The successful synthesis has also bolstered Samjin’s revenue base, as the company export the material to Southeast Asia, including Indonesia, China, and Singapore,

Samjin is also active in the development of new drugs. It is developing the world’s first dry eye syndrome therapy “SA-001” and pushing to develop gel-type AIDS (Acquired Immune Deficiency Syndrome) protection drug IQP-0528 for women, jointly with Imquest of the United States.

Only, the ratio of R&D spending against sales, which stood at a relatively low level of 7.19 percent last year, leaves much to be desired.

The domestic pharmaceutical industry regards CEO Lee as a top manager with soft leadership. Although he is at the highest position of a major company, Lee takes care of community affairs, large or small, and participates in most important events of health and medical circles. Because he doesn’t like noisy protocols, he goes to these events with a minimal number of people or rather attends them by himself.

Also, Lee asks all staffs to get a flu shot at the company, provides breakfast, and checks the clothes and shoes of the salespeople, which have now become famous within the industry. Thanks to these efforts, Samjin has continued to settle wage negotiations without disputes, and even without bargaining at all.