Population aging would change pharmaceutical industry’s paradigm, analysts say

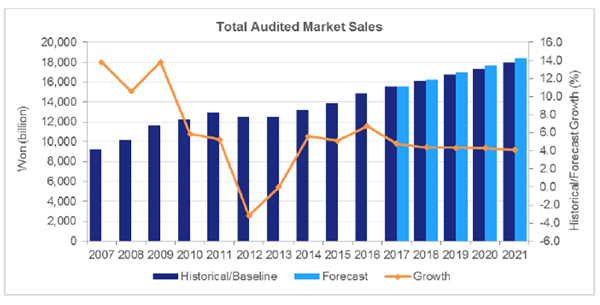

Korea’s pharmaceutical market is likely to grow 4.4 percent on annual average over the next five years, an international consultant said.

The rapid growth pace, which is nearly double the GDP increase rate of 2.3 percent during the period, is attributable to changes in China’s economic paradigms as well as population aging, it added.

IMS Health, a healthcare data provider and consulting agency, has forecast in a recent report that Korea’s pharmaceutical market would expand 4.4 percent a year on average until 2021, far higher than its real GDP growth rate of 2.3 percent, to 18.58 trillion won ($16.47 billion).

The report, titled “IMS Market Prognosis 2017-2021, South Korea,” cited the Chinese economy’s paradigm change as one reason for the rapid expansion of Korea’s medicine market. As China’s economy changes toward consumer- and service-oriented market, it would increase Korea’s export opportunities and lead the latter’s economic growth in 2021, it said.

The report also forecasted Korea’s aging population aging would also exert significant influence on its pharmaceutical market. It noted 13 percent of health insurance subscribers last year were patients aged 65 or older. The medical costs spent on these patients amounted to 25.2 trillion won or 39 percent of the total costs. That marked a drastic increase from the comparable rate of 24 percent in 2005. After all, the growing use of medicines because of population aging and other reasons would expand the size of the pharmaceutical market, too, the report said.

Also noteworthy would be the sharp increase in insurance benefits for high-priced innovative products, anticancer treatments and “orphan drugs,” it noted. Thanks to the government’s policy changes introduced in 2015, including the risk-sharing system of developed medicines, the report said, the insurance coverage would expand for expensive new drugs, particularly cancer drugs and rare medicines.

It also predicted that some innovative drugs developed in Korea would get preferential prices and rapid insurance coverage. Expanded health insurance for four major diseases -- cancer, cardiovascular, cerebrovascular and rare diseases – would also contribute to the growth of the medical supplies market.

Anticancer drugs and immunomodulators will grow 8.5 percent annually in the future, and the therapies of diabetics and digestive system will also rise 5.2 percent, it forecast.

“The projected annual growth rate of Kora’s pharmaceutical market will be 4.4 percent by 2021, two times higher than 2.1 percent of the average growth rate in advanced countries except for the U.S., and Korea’s GDP growth rate of 2.3 percent,” said Huh Kyung-hwa, CEO of IMS Health Korea. “The future of Korea’s medicine market is bright.”

The global movement for accessibility to medical supplies and efforts to improve drug efficacy will change the paradigm of the market, she added, noting that the domestic industry will have to resume the discussion of some issues to improve the efficiency of the insurance system, including the prices of generics and new drugs.