When foreign experts look at the Korean pharmaceutical industry, they wonder whether the sector meets three requirements: does it have the scale to invest in R&D, the science and technology to compete with advanced tech hubs such as Boston or San Francisco, or management capacity to run global R&D programs?

So did Axel Baur, senior partner and leader of McKinsey’s Asia Healthcare Practice, at the Global Bio Conference 2017 Wednesday. “These are three valid questions,” he said. “How is Korea going to compete against the 800-pound gorilla that is multinational pharmaceutical companies?”

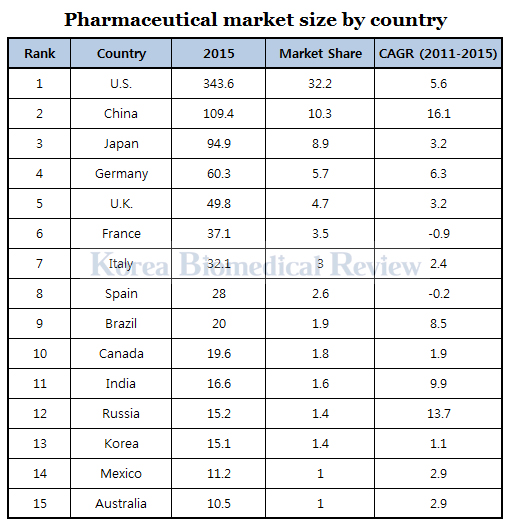

Most experts would answer in the negative to the three questions, considering Korea’s pharmaceutical industry is a small player in the global pharmaceutical market, ranking as the 13th largest pharmaceutical market in the world and accounting for around only 1.5 percent of the global marketplace.

In this regard, Axel believes that Korean firms need to apply a simple strategy that highlights the country’s strengths and help differentiate their products in the global market. Currently, Axel believes that Korea is looking the wrong way in value creation by trying to emulate the Big Pharma model.

“The point is to stop thinking about Big Pharma,” Axel emphasized, saying that Big Pharma is contributing only 60 percent of value creation in the overall market. “The remaining 40 percent comes from small- and medium-sized biotech companies. Learn from these biotechs, which is an innovation source.”

According to the McKinsey analyst, the success of small U.S. biotechs is attributable to four main factors: highly focused innovation portfolios based on scientific insight, lean and purpose-built teams that act quickly to apply scientific findings, market-tested development strategies for funding, and an externalized R&D operating model that uses qualified eco-system partners.

Korean companies should glean insight from the success of these relatively small players that have been able to achieve innovation in an investment-heavy industry such as the pharmaceutical industry.

In his analysis, Axel pointed out that Korean companies have not been able to adopt the success factors of small U.S. biotechs primarily due to a lack of scientific, technologic, and management focus to navigate the continually changing global pharmaceutical market.

In particular, Korean companies have struggled to differentiate themselves due to having broad research scopes that follow the latest global or local industry trends without considering the best product to develop for the country individually.

In this regard, Michael Goettler, global president, rare disease for Pfizer’s innovative health business, offered a word of caution while pointing out a trend in Korean pharmaceuticals.

“There is a tendency in Korea to follow the same thing. Everyone follows the ‘hot’ topic. It’s like when kids are playing soccer – they all run toward the same ball,” Goettler said. “If you want to have a healthy ecosystem that you benefit from, then we need different players playing different positions on the field. When the players serve different roles, everyone benefits. It makes the team stronger.”

Korean pharmaceutical companies also tend to have a “Korea-centered approach” to development wherein companies start clinical trials in Korea without a proper market strategy, Axel noted. In this regard, the consulting guru says, “If you are a biotech company in Korea that looks at the Korean market only, then you need to stop doing this, now. You cannot limit yourself to your home market, which has been Japan’s go-to strategy that has worked in the past but will not function anymore. Korea is not the holy grail of success.”

When asked about the Korea’s strengths, Axel pointed to two Korean companies, Samsung and Humira, to highlight domestic firms that have challenged multinational or foreign businesses in the global sphere using their expertise.

“It’s not always about the idea,” Axel explained further. “It’s also about execution.”

Therefore the Korean-model for success can be summarized by identifying the company’s R&D “sweet spot,” adopting a Korean-specific R&D ecosystem model, applying a global BD tested development strategy, understanding end-to-end requirements beyond discovery and having a short to mid-term cash flow plan.