Korea’s export of medicines and medical equipment exceeded $10 billion for the first time last year, the Ministry of Health and Welfare said.

Various management indices of the healthcare industry, such as the sales growth rate, operating profit rate and research and development expense increase rate of listed companies, also improved in 2016, it added.

These and other facts were in the ministry’s “report on healthcare industry’s export and management outcome in 2016,” released Thursday.

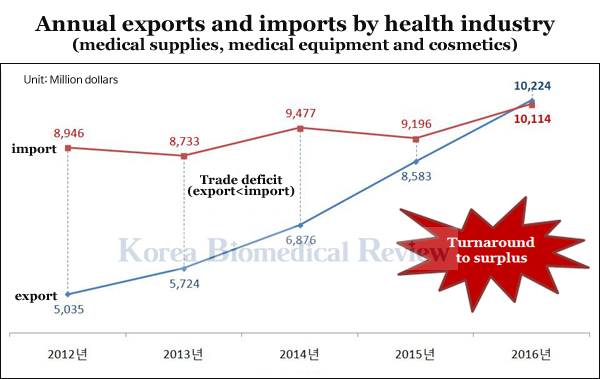

According to the report, the healthcare industry’s export (of medical supplies, medical equipment, and cosmetics) totaled $10.2 billion last year. It was the first time the figure exceeded $10 billion, which also recorded an annual increase of 19.4 percent over the past five years.

The 2016 export also marked the increase of 19.1 percent from $8.6 billion in 2015 and attained the trade surplus of $100 million, also for the first time in history, thanks to the sharp rise in foreign shipments.

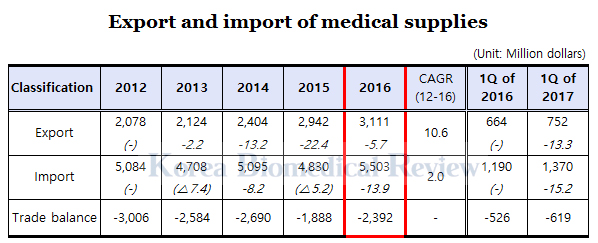

By industry, the export of medical supplies increased 5.7 percent from 2015 to hit a record high of $3.1 billion, and import has jumped 13.9 percent to $5.5 billion.

Notably, the export of raw material medicine amounted to $1.4 billion, recording an 8.4 percent growth year to year, and the number of companies that exported high-quality medicinal materials to global multinational pharmaceuticals also increased.

The medical supply export in the first quarter of this year totaled $750 million (845.9 billion won), up 13.3 percent from the same period of last year and continuing the steady growth trend.

Medical equipment export increased 7.7 percent to $2.9 billion (3.5 trillion won), and import rose 7.0 percent to $3.2 billion.

The United States was the biggest export destination for Korean medical equipment by importing $500 million worth last year, followed by China ($440 million) and Germany ($250 million). Exports evenly increased not just to emerging countries but industrial nations, such as the United Arab Emirates (51.5 percent), China (34.3 percent), Vietnam (30.7 percent), and France(14.8 percent).

Medical equipment export in the first quarter of 2017 increased 10.0 percent from a year earlier to $680 million (763.2 billion won).

On healthcare industry’s management performance, the sales and R&D expenses of 175 listed companies increased 12.5 percent and 20.4 percent, respectively, last year compared with 2015.

Their combined 2016 sales jumped 12.5 percent to 30.8 trillion won – 9.9 percent for medicines, 9.8 percent for medical equipment, 17.0 percent for cosmetics.

Total R&D spending jumped 20.4 percent to 1.7 trillion won ($1.5 billion) – 21.1 percent for drugmakers, 14.5 percent for medical equipment manufacturers, and 21.3 percent for cosmetics makers.

The combined sales of 109 listed pharmaceutical companies rose 9.9 percent to 17.1 trillion won riding on increases in technology transfer and export growth.

Mainly, Youhan Corp.유한양행 and Green Cross녹십자 continued to attain the 1 trillion won landmark in annual sales, following 2015 with Youhan remaining in the 1 trillion won sales club for the third consecutive year.

The R&D spending by pharmaceutical companies jumped 21.1 percent to 1.3 trillion won, and the R&D expense’s rate against sales also rose to 7.8 percent from 7 percent in 2015.

The R&D spending by 28 pharmaceutical venture companies soared 47.5 percent, from 93.3 billion won to 137.6 billion won, with their R&D expense accounting for 20.5 percent of sales.

The aggregate sales of 42 medical equipment makers increased 9.8 percent to 2.1 trillion won, and the number of equipment makers that recorded more than 100 billion won in annual sales increased from six to seven over the cited period.

The R&D costs of medical equipment makers climbed 14.5 percent to 181.2 billion won with their R&D cost-sales rate standing at 8.4 percent, more than twice higher than enlisted manufacturing firms’ average of 3.4 percent.

The R&D costs of 25 venture firms making medical equipment edged up 1.2 percent to 73.2 billion won, accounting for 9.4 percent of their sales.

“The sharp, across-the-board export increase recorded by healthcare industries shows the sector is growing into a new future industry,” said Yang Sung-il양성일, director-general of the ministry’s Health Industry Policy Bureau. “In the second half of this year, we will support the development of healthcare industry systematically, by setting up a comprehensive plan to develop pharmaceutical, medical equipment, and cosmetics sectors.”