Bristol-Myers Squibb (BMS) and Merck, Sharp and Dohme (MSD), a subsidiary of Merck & Co., have been locked in a head-to-head race to become the leader in the U.S. immuno-oncology market.

Currently, BMS’ Opdivo is shooting ahead, and MSD’s Keytruda is chasing fiercely. However, recent conflicting results of their clinical trials have not affected much the stock prices of the two pharmaceutical giants.

The U.S. Food and Drug Administration Wednesday ordered a halt on three Keytruda clinical trials for multiple myeloma, finding more patients died taking a Keytruda (ingredient: pembrolizumab) combination than the control group. The federal agency blocked further testing in KEYNOTE-183 and KEYNOTE-185, while partially withholding testing in KEYNOTE-023. The trials compared Keytruda with Celgene’s Revlimid or Pomalyst.

The announcement follows MSD’s decision last month to stop enrolling new patients in its clinical trials for multiple myeloma due to the emerging deaths.

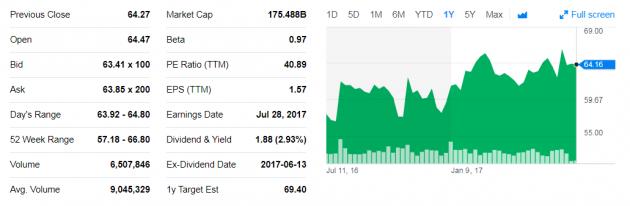

However, the recent news hasn’t shocked investors much, with MSD stocks falling only 1 percent on Wednesday from $64.16 to $63.40.

Meanwhile, Bristol-Myers Squibb brought some good news Thursday, saying its blockbuster drug Opdivo (ingredient: nivolumab) reached its primary endpoint in clinical trials that compared it with Yervoy – proving Opdivo’s superior recurrence-free survival (RFS) rates in melanoma patients. Although industry watchers expect Opdivo to cannibalize Yervoy sales, another BMS drug, the result is refreshingly optimistic for BMS who has seen trouble with Opdivo in previous trials.

“These topline results support the potential promise of Opdivo as a treatment option for patients with high-risk surgically resected melanoma,” said Vicki Goodman, development lead at BMS’s Melanoma and Genitourinary Cancers.

Despite significant results, BMS stocks only rose 1 percent Thursday.

Race between Bristol-Myers Squibb and Merck & Co

Competition between BMS and MSD in the immuno-oncology market spans back to 2014 after Keytruda gained FDA approval three months before Opdivo.

Despite MSD’s head start, BMS won over investors in 2015 by announcing Opdivo proved remarkable success for melanoma, a type of skin cancer. Industry insiders noted that the result was a boon for BMS, as it had divested its diabetes sector in 2009 to invest heavily in its immuno-oncology division. And BMS had the numbers to show for it: Opdivo raked in $942 million globally compared to Keytruda’s $566 million.

As the perceived market leader, Opdivo had been rapidly gaining approval for indications such as melanoma, second-line non-small cell lung cancer, renal cell carcinoma, classical Hodgkin lymphoma, squamous cell carcinoma of the head and neck.

To expand its indications, BMS decided to conduct additional trials for non-small cell lung cancer (NSCLC) and beat out MSD. The clinical trial design was of critical importance: BMS could either go with a large test for a wide group of cancer patients with low levels of the particular tumor protein or aim for a narrow group of patients with a high degree of the blood cancer protein. BMS also had to choose the focus of the study, which was either to expand the overall survival rate of patients, the gold standard in immuno-oncology or to block tumor growth.

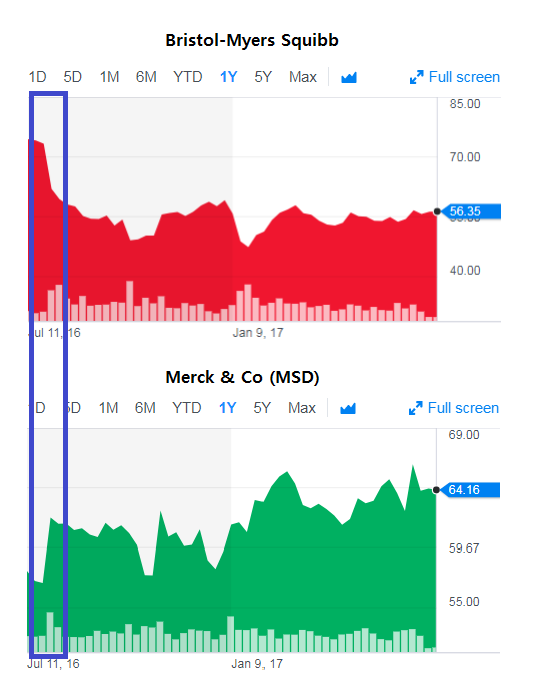

BMS made a big bet in 2016 to proceed with a broad group of cancer patients with the objective of preventing tumor growth – a move that industry insiders say caused the company to lose its place as the leader in the race. The clinical trial failed to prove Opdivo’s efficacy; in fact, it was no better than standard chemotherapy. The news dealt a blow to BMS stock prices, and the company’s stocks declined 20 percent over two days while Merck was up as much as 11 percent.

In the same period, MSD announced extraordinary results from Keytruda clinical trials, finding their drug increased the survival rate of lung cancer patients in comparison to those who took chemotherapy. MSD chose a conservative approach, focusing on the overall survival rate for a narrow group of patients who had the PD-L1 biomarker in at least 50 percent of their cells. And their approach won – MSD stocks shot up, leading the consulting firm EvaluatePharma to predict Keytruda would win over Opdivo in sales by 2022 with value creation to reach $69.5 billion. Their drug also became the first tumor-agnostic drug approved by the FDA.

With Opdivo’s setback in the clinical trial, BMS decided this past January to not apply for the U.S. fast-track designation for clinical trials that compared Opdivo and Yervoy in melanoma patients, indicating BMS’s low expectations. The next month, the company tried to win back investors, announcing it added three new directors to its board and buy back shares worth $2 billion from hedge fund Jana Partners LLC. Shares spiked 4 percent in the afternoon trading. However, stock prices failed to rally on the whole.

To the finish line: who’s the winner?

The recent FDA announcement hasn’t affected Merck’s stocks, indicating a lingering optimism in the market. Aside from the three withheld clinical trials, Keytruda is being tested in hundreds of combination trials worldwide for a wide variety of diseases.

“Patient safety is Merck’s primary concern, and we are grateful to the study investigators and patients involved in these studies for their commitment to this important research,” said Roger Perlmutter, president of Merck Research Laboratories. “Merck’s development program for Keytruda, spanning more than 30 different tumor types, has one priority: helping patients suffering from cancer.”

So far, Keytruda is approved for classical Hodgkin lymphoma and has also seen success with people with advanced melanoma, advanced bladder cancer and a type of head, lung and neck cancer. In May, Keytruda became the first cancer drug to win U.S. approval based on a patient's specific genetic traits, regardless of which part of the body the disease originated, known as microsatellite instability-high cancer.

BMS for its part announced Monday that it had started phase 3 clinical trials for Opdivo with Exelixis to evaluate the drug as a treatment for patients with previously untreated advanced or metastatic renal cell carcinoma (RCC). The primary endpoint is progression-free survival (PFS).

Opdivo sales in the past year were $4,735 million, and EvaluatePharma predicted its expected compound annual growth rate to reach 13 percent through 2022. Keytruda sales in the same period amounted to $1,402 million with an expected CAGR of 38 percent, according to EvaluatePharma.

“We are committed to researching therapies that may better meet the needs of this patient population and look forward to sharing these data with health authorities soon,” BMS Vicki Goodman added.

As for market share, BMS currently remains ahead, leading with 7.4 percent, and Merck & Co with 1.8 percent, according to EvaluatePharma. The two have also engaged in the patent front, with BMS winning a settlement from Merck on Keytruda’s infringement on Opdivo.

Other competitors, Celgene and AstraZeneca, are also in the race, although far behind in the PD-1 inhibitor market.

Numbers aside, all developments are good news for cancer patients who are eagerly awaiting developments in the immune-oncology market, industry watchers say.