To develop a globally competitive homegrown blockbuster drug, Korean pharmaceutical companies should choose the most prominent pipelines and concentrate on them, experts said.

The Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) held a press webinar on the pharmaceutical and biotech industry on Wednesday.

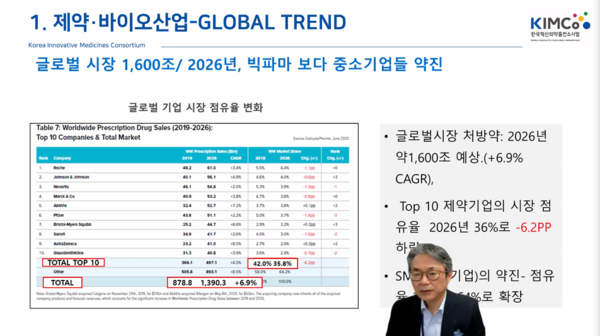

At the online conference, experts shared industry trends for the development of K-blockbuster drugs. K-blockbuster drug refers to a new medicine that can sell over $1 billion annually in the global market.

Korea Innovative Medicines Consortium (KIMCo) CEO Huh Kyung-hwa and Bridge Biotherapeutics Director Chee Dong-hyun spoke in one voice that companies needed a “choice and concentration strategy” to develop Korean blockbuster drugs.

Huh said Korean pharmaceutical businesses should achieve economies of scale.

“Korean companies’ R&D has become much more active than before, but compared to multinational drugmakers, it is still on a small scale,” Huh said.

While 113 listed firms spend a combined 2.7 trillion won on R&D, the amount is similar to the R&D cost of a single company, Roche, he said.

The local pharmaceutical and biotech industry requires a paradigm shift to be able to produce a blockbuster drug, Huh said.

In particular, the industry needs a megafund to focus on late-stage trials and the government should evaluate technological innovation and business feasibility to select a “national representative new drug,” he went on to say.

Korean companies are developing 919 pipelines but about 30 of them can be national representative drug candidates based on the review of 180 developers for new targets, clinical proof of concept (POC), and clinical trial entry, according to Huh.

Huh also emphasized the roles of private and public entities.

“The government should now serve as an investor rather than a sponsor, and private investors need to participate in private funds for late-stage clinical studies,” he said.

Emphasizing the importance of clinical development strategies, Chee said technology transfer could be the key to develop a novel drug because the costs of clinical development are astronomical.

However, global development and a global launch are extremely rare in Korea, she said.

“Companies should not expect that they could develop a new drug by chance. They should increase investment in drugs that can enter the market and cut the money on drugs that can’t,” Chee said. “Companies should make selected candidates quickly enter confirmatory clinical stages.”

She also emphasized the need to develop a strategy for clinical development.

Korean companies have many clinical trial operators but rarely have clinical developers, she said.

Good clinical development is to “begin with the end in mind,” Chee went on to say.

“Companies should fully consider how their drug will look in the market, whether physicians will prescribe it, whether there will be patients, and whether this drug will win the competition against the rival drug or it can be used with it.”