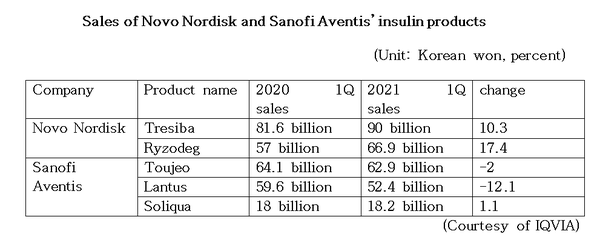

Novo Nordisk and Sanofi Aventis, the two dominant insulin providers in Korea, have shown mixed sales performances in the first quarter.

According to IQVIA, a drug market research company, Novo Nordisk finally surpassed Sanofi in the first three months, as Tresiba and Ryzodeg generated robust sales in the insulin market in the first three months.

The second-generation long-acting insulin Tresiba recorded sales of 9 billion won ($8.5 million) in the first quarter, up 5.1 percent from the same period last year and recording the highest sales among local insulin products and widening the sales gap with other insulin treatments.

Ryzodeg, launched in 2017 by combining Tresiba with Novorephid, a dietary insulin formulation, was the runner-up. Ryzodeg surpassed Sanofi's second-generation long-acting insulin, Toujeo, with sales of 6.69 billion won. Ryzodeg's sales grew 17.4 percent from the same period of 2020 while those of Toujeo declined by 2 percent.

The situation was similar for other insulin products.

Sanofi's Lantus, first-generation long-acting insulin that had dominated the local insulin prescription market since its introduction in Korea in 2005, also saw a 12.1 percent drop in sales year on year.

The drug’s quarterly sales once exceeded 7 billion won but lost market share due to new products.

Soliqua, launched by Sanofi in 2018 by combining Lantus with Lyxumia, a GLP-1 analog, also remained stagnant with the sales gain of a mere 2 million won over the cited period.