“With the inauguration of the Biden administration, Korean pharmaceutical and biotech companies are expected to face both challenges and opportunities.”

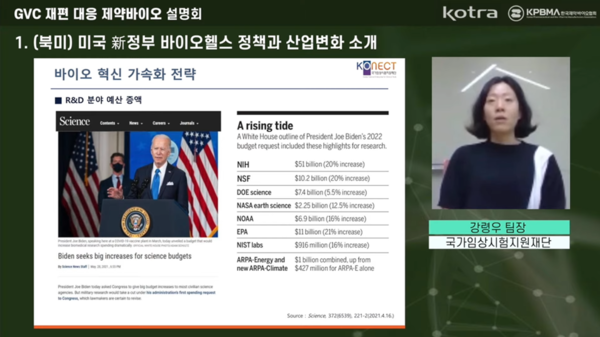

Kang Ryung-woo, senior research director at the Korea National Enterprise for Clinical Trials (KoNECT), said this and other remarks at an online conference on the pharmaceutical industry’s response to the U.S. restructuring of the global value chain (GVC) on Tuesday.

The conference was hosted by the Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) and the Korea Trade-Investment Promotion Agency (KOTRA).

During the forum, Kang analyzed U.S. President Joe Biden administration’s bio-health policies and commented on how Korean companies should respond.

“After Joe Biden took office as U.S. president on Jan. 20, the U.S. administration is announcing a series of new bio-health policies,” Kang said. “Policies in the pharmaceutical and biotech sector, announced by the progressive Biden administration, are expected to be more favorable to Korea’s exports and overall economic growth.”

The Korean pharmaceutical industry is paying particular attention to Biden’s move to strengthen the Affordable Care Act (ACA), also known as Obamacare, once weakened by the Trump administration.

The U.S. government plans to raise the health insurance coverage to over 97 percent of the U.S. population, reinforce the public health insurance system, and expand tax benefits for medical cost reduction.

To relieve the pressure on health spending amid the expansion of Obamacare, the Biden administration is encouraging the use of biosimilars, which are about 20-50 percent cheaper than original drugs.

“Such bio-health policies of the Biden administration are likely to help the Korean biosimilar and oncology drug market grow further,” Kang said.

Kang predicted that the global biosimilar market would expand at an annual rate of 139.4 percent, from $29 million in 2020 to $5.46 billion in 2026. “The Biden administration’s biosimilar friendly regulations are expected to accelerate the growth of the global biosimilar industry,” she said.

In Korea, Samsung Bioepis, Celltrion, Dong-A ST, Chong Kun Dang, Alteogen, and PharmAbcine focus on the development of biosimilars in time for the expiration of original drugs by multinational pharmaceutical firms. Starting with Celltrion’s Remsima injection in 2013, 16 Korean biosimilars have obtained the regulatory nod and are now in sale, Kang explained.

As a leader of the global biosimilar sector, Korean biosimilar makers will have an opportunity to tap the U.S. biosimilar market. Still, they will need a sophisticated entry strategy, she said.

Also, as the Biden administration pushes for a project to end cancer, Korean companies need to come up with corresponding strategies, Kang noted.

On Feb. 19, Biden announced that the U.S. government would concentrate its capacity to end cancer once the Covid-19 pandemic is over. He said he would resume the Cancer Moonshot Initiative (CMI), started by the Obama administration but halted in the Trump era.

CMI aims to develop tumor markers through genome analysis of cancer patients on a large scale, develop data-based customized anticancer treatments, and establish a foundation for ending cancer through vaccine development.

The initiative will also enhance support for cancer research, expand cancer screening and diagnostic methods, and standardize and share data across countries.

The U.S. government has spent about $1.2 billion in Moonshot funding so far, supporting over 240 research projects across more than 70 cancer science initiatives.

In 2020, the number of global oncologic drug pipelines stood at 6,504, accounting for 36.7 percent of the total pipelines, according to Kang.

In Korea, the number of clinical trials of anticancer drugs authorized by the Ministry of Food and Drug Safety recorded 207, which took up 29 percent of all clinical trials in 2020, she said.

“Worldwide, anticancer pipelines are rapidly expanding with pharmaceutical firms’ aggressive investment. Korean companies also need active growth strategies to speed up anticancer drug development and enter the global market,” she added.