Medicinal products developed with homegrown technology have entered the ranks of blockbuster drugs with annual prescriptions of more than 100 billion won ($86.7 million), industry watchers said Friday.

For instance, LG Chem's Zemiglo, Boryung Pharmaceutical's Kanarb, Hanmi Pharmaceutical's Amosartan, and Daewoong's Olostar have established themselves as sources of net profits for the company by adding combination drugs to their lineup.

The companies’ strategy to expand their hit products’ brand values instead of remaining content with the success of a single item has worked, they said.

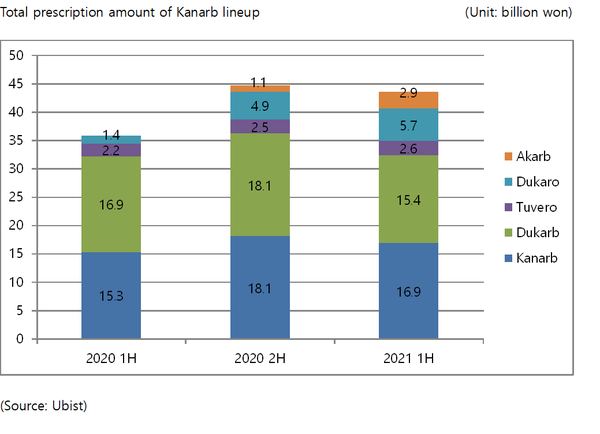

In terms of growth, Boryung Pharmaceutical's Kanarb lineup stood out most prominently. According to a report from Ubist, a drug market research firm, the accumulated prescription amount for the Kanarb lineup was 56.4 billion won ($50.5 million) in the first half of this year, an increase of 16.1 percent from a year earlier.

The lineup consists of Kanarb (fimasartan) and five other combination drugs including, Kanarb Plus (fimasartan/hydrochlorothiazide) and Dukarb (fimasartan/amlodipine), which contain two components of antihypertensive treatment, and Tuvero (fimasartan/rosuvastatin), Dukaro (fimasartan/amlodipine/rosuvastatin), and Akarb (fimasartan/atorvastatin), which contain medicines for antihypertensive and dyslipidemia.

If the current trend continues, the company will likely exceed 100 billion won in sales for its lineup for the second consecutive year.

Boryung plans to increase the sales of its Kanarb lineup to 200 billion won by 2025.

With the core patent of Kanarb expiring in 2023, the company plans to expand its indications to promote sustainable growth and accelerate the development of a new combination drug based on Kanarb.

Boryung expects to launch its seventh product of the Kanarb lineup as early as in the first half of next year.

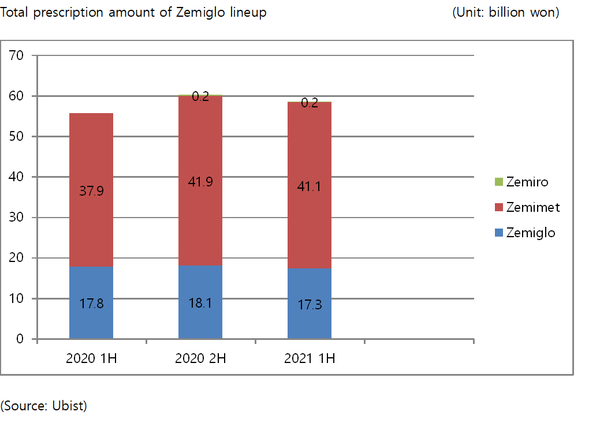

In sales amount, LG Chem's Zemiglo topped the list by recording 58.7 billion won in the first half-year sales, up 4.8 percent from the same period of last year.

The lineup consists of Zemiglo, a DPP-4 inhibitor type diabetes treatment, Zemimet, a combination of metformin with Zemiglo, and Zemiro, a combination of Zemiglo with rosuvastatin, a dyslipidemia treatment ingredient.

The company managed to consistently challenge MSD's Janumet, which had maintained a firm position in the DPP-4 inhibitor market in the past. In the third quarter of last year, the company's Zemimet finally surpassed sales of MSD's Janumet and has since held the lead.

Industry insiders point out that steady investment in research and development was the main reason Zemiglo, which has reached its 10th year after launch, could grow into a flagship product of LG Chem's life science division.

The local DPP-4 inhibitor market has already been saturated with nine more similar products to Zemiglo competing fiercely.

LG Chem initially invested about 50 billion won in developing Zemiglo and poured additional spending of more than 80 billion won to conduct comparative tests with competitors and develop additional combination drugs.

Through such investments, the company proved the lineups’ excellent blood sugar-lowering effect and safety and secured differentiation from competing drugs in the same class by confirming the reduction of the risk of hypoglycemia by minimizing the range of blood sugar fluctuations, it said.

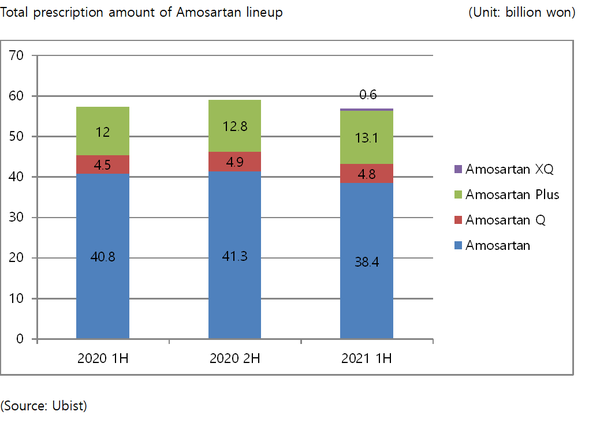

Hanmi Pharmaceutical aims to claim the top position in the local hypertension combination treatment market with its Amosartan lineup, backed by differentiated data and a wide lineup, with the lineup posting a cumulative prescription of 57.1 billion won the first half of this year.

Amosartan lineup consists of Amosartan, Amosartan Q, and Amosartan Plus, Amosartan XQ.

Although the total prescription amount is a slight decrease of 0.6 percent from 57.4 billion won recorded in the same period of the previous year, the lineup still played a significant role as one of the company's main sources of revenue by maintaining the prescription record despite the chaos of Covid-19 outbreak.

Amosartan XQ, the world's first four-ingredient combination therapy that the company launched in February, also successfully debuted after recording 600 million won in the total prescription amount in the first half of this year.

Daewoong's Olostar lineup has also made a remarkable process.

The lineup posted an accumulated prescription amount of 7.5 billion won, increasing 33.5 percent from the previous year.

Daewoong first released Olostar, the world's first combination drug that combined angiotensin II receptor blocker (ARB)-based Olmesartan and a statin-based Rosuvastatin, in April 2014.

Since its launch, the drug has shown explosive growth after recording sales of 5 billion won just nine months after its release and grew sharply to 12.1 billion won in sales in 2017.

With the emergence of numerous competitive combination drugs, the growth trend has since slowed somewhat. However, the drug remains one of the leading hypertension combination drugs.

In May of 2019, Daewoong went one step further by launching Olomax, a three-drug combination drug that added a calcium channel blocker (CCB)-based amlodipine to Olostar.

Olomax is the world's first incrementally modified drug that combines angiotensin II receptor blocker (ARB)-based olmesartan, calcium channel blocker (CCB)-based amlodipine, and statin-based rosuvastatin in one pill.

Olomax proved the effect of lowering blood pressure and improving lipid levels through multi-center clinical trials in Korea and showed rapid growth by entering four of the "Big Five hospitals" in Korea within six months after its launch.