The fiasco over carcinogen-containing valsartan drugs that broke out three years ago changed the prescription market for valsartan-based antihypertensive single and combination drugs.

In July 2018, the Ministry of Food and Safety had prohibited sales of 174 valsartan-based hypertension treatments after detecting N-Nitrosodimethylamine (NDMA) in medicines containing valsartan manufactured by China's Zhejiang Huahai Pharmaceutical.

The prohibited drugs accounted for 30 percent of the 571 locally approved valsartan products at that time.

After the ministry suspended sales of most locally manufactured generic products containing valsartan, original products manufactured by Novartis Korea benefitted greatly, as the company pushed for aggressive marketing to expand a market share.

While the ministry has allowed the resumption of sales for all locally manufactured valsartan drugs since August of last year, local generic makers seem to be still reeling from the aftershock of the incident, while Novartis continues to reap the benefits.

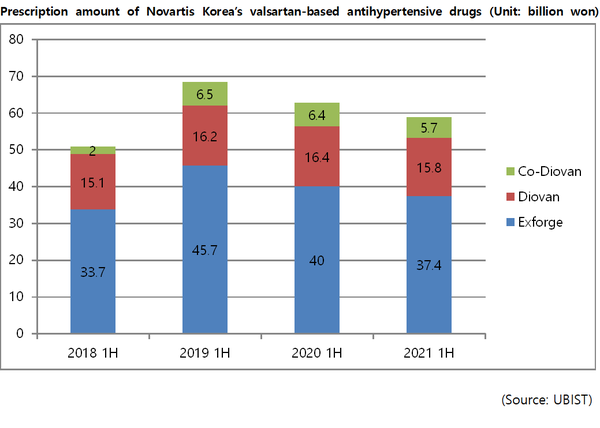

According to UBIST, a drug market research firm, three types of ARB (angiotensin receptor blocker) antihypertensive drugs owned by Novartis Korea, such as Exforge, Diovan, and Co-Diovan, jointly amounted to 58.9 billion won ($51.2 million) in outpatient prescriptions in the first half of this year.

Although the amount marked the decline of 6.3 percent from 62.9 billion won in the first half of last year, the prescription performance increased 6.4 percent compared to 55.4 billion won in the first half of 2018 before the valsartan fiasco.

Notably, the growth of Exforge was most remarkable.

The number of outpatient prescriptions for Exforge in the first half of this year was 37.4 billion won.

Although it decreased by 6.7 percent from the 40 billion won recorded during the same period last year, it increased 10.9 percent from 33.7 billion won in the first half of 2018.

The prescription performance of valsartan single drug Diovan showed a similar trend. In the first half of this year, the cumulative prescription for Diovan was 15.8 billion won, down 3.8 percent from the same period last year.

However, the figure is still higher than the increase from the 15.1 billion won reported in the first half of 2018.

On the other hand, there has been no significant change in the prescription performance of Co-Diovan, which is a combination drug that combines valsartan with a hydrochlorothiazide-type diuretic.

The company has maintained a monthly prescription amount of around 1.1-1.2 billion won Co-Diovan for the past three years.

Despite the success of original drugs from Novartis, valsartan-based generic drugs, which were ranked at the top until the first half of 2018, have still not recovered from the decline in prescription performance after the impurity crisis.

The UBIST data of the prescription amount for each major product in the valsartan and amlodipine combination market based confirmed that there had been a significant change in the past three years.

Hutex's Exforte, which recorded 5.4 billion won in prescriptions in the first half of 2018, only registered 1.4 billion won in prescriptions in the first half of this year.

Daewon Pharmaceutical's Excombi also saw its prescription amount decrease by about 90.7 percent from 4.7 billion won in the first half of 2018 to 400 million won in the first half of this year.