Sotorasib and adagrasib are expected to compete with each other in the Kras G12C inhibitor market, which is regarded as a promising oncology field worldwide, industry officials said.

Kras G12C is a mutation in multiple cancers, including lung, colorectal, and pancreatic cancers.

On Tuesday, Novartis disclosed the timeline of Kras G12C inhibitor JDQ443 development when it released its third-quarter earnings.

Novartis is testing JDQ443, an investigational Kras G12C inhibitor, in a phase 1/2 trial in patients with Kras G12C mutated advanced solid cancer.

“JDQ445 showed good results in pharmacokinetic properties and dose setting. In addition, it demonstrated a suitable profile to conduct a phase 3 trial in other types of cancer including non-small cell lung cancer (NSCLC),” an official at Novartis said.

The company plans to conduct a phase 3 trial of JDQ445 as the second-line and third-line treatment of advanced lung cancer in the first half of 2022.

According to Clinicaltrials.gov, the phase 1/2 trial of JDQ443 is expected to reach the primary endpoint in August 2024. This indicates that Novartis can release the drug in the U.S. only after 2024.

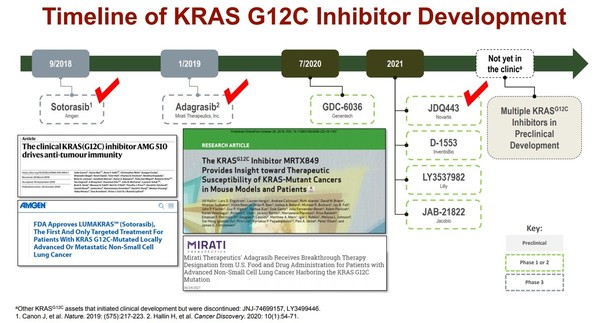

Considering that JDQ443 has progressed the most in development stages among experimental Kras G12C inhibitors, except for adagrasib developed by Mirati Therapeutics, the Kras G12C inhibitor market is expected to be a battle between Amgen’s sotorasib and Mirati’s adagrasib for some time, observers said.

Amgen’s sotorasib (brand name: Lumakras) obtained FDA approval as a treatment for NSCLC with Kras G12C mutation in late May, becoming the first-in-class Kras G12C inhibitor.

After discovering Kras gene mutation, numerous pharmaceutical companies have tried but failed to develop a Kras mutation inhibitor.

However, Amgen developed the first targeted therapy for Kras mutation in 40 years.

Mirati said it would apply for the marketing approval of adagrasib to the FDA within the fourth quarter of this year, hinting at a market release in the U.S. in the first half of 2022.

Adagrasib proved effective not only in Kras G12C-mutated NSCLC but colorectal cancer. Thus, if the FDA grants the permit as expected, adagrasib is expected to enter the Kras G12C-mutated colorectal cancer treatment market for the first time.

In Korea, sotorasib and adagrasib have yet to win the license.

After getting FDA approval for sotorasib in May in the U.S., Amgen immediately applied for the Ministry of Food and Drug Safety’s permit in Korea.

Amgen has been conducting not only early-stage but confirmatory phase 3 trials of sotorasib in Korea.

As the phase 3 study ends in February next year, the company hopes to obtain the nod in the first half of next year.

Mirati is also testing adagrasib in a local phase 3 trial to treat NSCLC and colorectal cancer.

The company received the regulatory nod for the phase 3 trial for NSCLC in June and colorectal cancer in September.

The pharmaceutical industry pays attention to how adagrasib will be authorized and sold in Korea.

Mirati has neither a Korean offshoot nor a sales network here. However, another pharmaceutical company will likely seek sales rights of adagrasib, sources said.

News reports said MSD could seek to acquire Mirati, drawing attention to who will be the rival against Amgen in the Kras inhibitor market in Korea.

Both Mirati and Amgen set MSD’s Keytruda (pembrolizumab) as a combination drug to evaluate the effect of combining their Kras G12C inhibitors with an immune checkpoint inhibitor, respectively.