Korea’s state health insurance recorded a “surplus” of 2.82 trillion won ($2.34 billion) last year.

In the early stage of the “Moon Jae-in care” – a policy to expand medical insurance coverage -- concerns mounted about depleting health insurance finances. However, the prolonged Covid-19 pandemic over the past two years seems to have reduced the use of medical services, slowing down the growth rate of its expenditure, officials said.

On Friday, the National Health Insurance Service (NHIS) released its financial situation based on cash flows in 2021. According to the report, the health insurance fund increased by 2.82 trillion won, pushing the accumulated reserve to 20.2 trillion won.

Compared with the previous year, revenue jumped 9.6 percent to 7.73 trillion won. In comparison, expenditure’s growth rate stopped at 5.3 percent to a total of 3.89 trillion won, it said.

The revenue increase was attributed to an increase in the number of insurance subscribers (2.7 percent in workplace subscribers and 3.0 percent for district subscribers), wage increases (2.1 percent), increased government subsidy (from 9.2 trillion won in 2020 to 9.6 trillion won in 2021), and insurance fee hikes (2.89 percent).

In contrast, the growth rate of health insurance expenditure was lower than pre-Covid-19 years, as personal hygiene, such as mask-wearing and hands washing, has become a part of daily life, reducing the numbers of respiratory disease patients like cold and pneumonia, other infectious disease patients, and digestive disease patients.

The expenditure growth rate in the previous two years stood at 5.1 percentage points (from 8.7 percent in 2018 to 13.8 percent in 2019). Still, the comparable rise in the past two years stood at 1.2 percentage points (from 4.1 percent to 5.3 percent).

It cost 2.1 trillion won to support Covid-19 response, including expenses for diagnostic tests, quarantine and treatment, subsidies for community treatment centers, support for at-home treatment, and implementing vaccination programs.

| Classification | 2021 (A) | 2022 (B) | Y-o-y comparison Growth rate | |

| (A-B) | (Percent) | |||

| Total revenue | 804,921 | 734,185 | 70,736 | (9.6%) |

| Total expenditure | 776,692 | 737,716 | 38,976 | (5.3%) |

| Surplus | 28,229 | Δ3,351 | 31,760 | - |

| Cumulative surplus | 202,410 | 174,181 | 28,229 | - |

Cash flow basis (Unit: 100 million won), Source: National Health Insurance Service

'The state health insurance agency said it plans to expand the medical safety net by gradually converting non-payment items with high medical demands, such as MRI and ultrasound scans, into payment items, raising medical expense subsidy rates in disasters and support amounts.

“We will strengthen stable revenue basis by solidifying fair insurance fee collection based on income in preparation for population aging and infectious disease crises,” the NHIS said. “We will also operate finances stably within a premediated extent by enhancing close monitoring of changes in expenditure and actively raising the efficiency of overall expenditure.”

However, the state health insurance organ expected the revenue growth rate to slow down. In contrast, the expenditure increase rate will be higher this year due to strengthened insurance coverage and continuous response to Covid-19.

The NHIS estimates it would spend 600 billion won a month on supporting rapid antigen tests at neighborhood clinics, 290 billion won for at-home treatment, and temporary test expenses of 30 billion won for conducting PCR tests on patients’ guardians and caregivers.

“For various reasons, including the need for continuous response to Covid-19, health insurance revenue growth will slow down while expenditure will grow rapidly this year,” the NHIS said. “We will do our best in fund operation to attain optimal profit rate.”

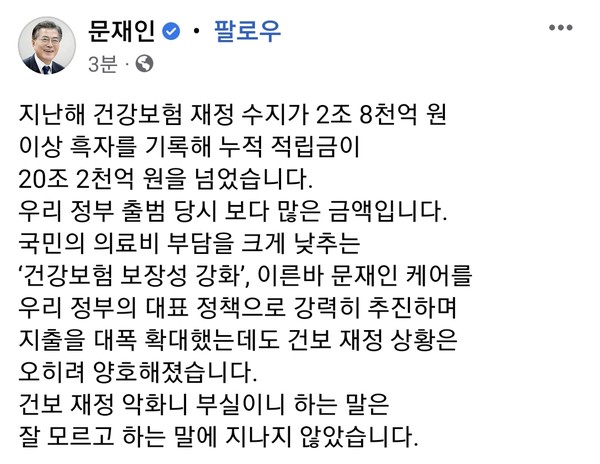

President Moon pleased with ‘improved health insurance finance’

Upon the news of national health insurance recording a surplus, President Moon Jae-in positively evaluated the policy.

Although the government sharply expanded expenditure by implementing the “Moon Jae-in care,”’ the insurance’s financial situation has instead turned for the better, the President said through SNS.

“The health insurance recorded a surplus of more than 2.8 trillion won last year to push the cumulative reserve to 20.2 trillion won. The figure is even larger than when our administration took office,” Moon said. “We sharply expanded expenditure, but finances have instead improved. Criticisms about aggravating health insurance finances were nothing more than the words of people who did not know well.”

The chief executive pointed out that the government has attained accumulated reserve twice higher than initially planned and curbed the insurance fee increase to an average of 2.7 percent, also lower than planned, managing to minimize burdens on the public.

“Such an accomplishment is all the more significant as we made it despite the hefty input of insurance funds into anti-Covid-19 fights by spending 2.1 trillion won for diagnosis, quarantine, and treatment,” President Moon noted.

When he took office in 2017, Moon announced his health insurance policy, saying that the government would 10 trillion won from the cumulative reserve of 20 trillion won on helping to ease people’s medical cost burdens while leaving the other 10 trillion won intact. The President also said that he would curb the insurance fee increase rate below the average 3.2 percent of the previous decade.

“The government will continue to manage health insurance finance stably and strive to lessen the people’s medical costs,” President Moon said. “It will keep expanding the medical insurance coverage and make the most of it to respond to the Omicron wave effectively.”