Korea’s biopharmaceutical companies and diagnosis kit makers showed mixed performances in the second quarter, depending on their CMO (contract manufacturing organization) businesses and the spreading curve of Covid-19, industry watchers said Friday.

Samsung Biologics and Celltrion Healthcare stood out among bio-pharmaceutical companies in the April-June quarter.

Thanks to the rapid growth of its CMO business, Samsung Biologics saw its first half-year sales exceed 1 trillion won ($768 million) for the first time. The company’s sales and operating profit in the first six months totaled 1.16 trillion won, and 346.1 trillion won. In the second quarter alone, its sales and operating profit stood at 651.4 billion won and 169.7 billion won.

If the company’s No. 4 plant begins operation in October as scheduled, it will account for 30 percent of global CMO production. “The combination of Samsung Biologics’ global manufacturing prowess and Samsung Bioepis’ R&D capability will make us a global player true to its name,” a company official said.

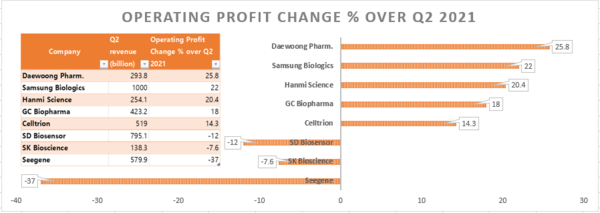

Celltrion posted sales of 519 billion won and an operating profit of 74.1 billion won in the second quarter, up 20 percent and 14 percent, respectively, from a year ago.

The relatively brisk performance was thanks mainly to the increased demand for its flagship biosimilars, such as Remsima, Truxima, and Herzuma, with an established presence in the U.S. and Europe. In addition, Humira and Avastin biosimilars will also likely obtain EU and FDA approval to contribute to second half-year revenue, Celltrion said.

The company has developed future growth engines by expanding strategic alliances with Iksuda Therapeutics, a British company specializing in antibody-drug conjugates, and Go Bio Lab, a domestic firm that will jointly develop microbiome treatments, it added.

In contrast, SK Bioscience, despite making a big wave with Korea’s first homegrown Covid-19 vaccine, SKYCovione, saw its second-quarter revenue drop 7.6 percent to 138.3 billion due to declinings CMO orders. Its net profit also fell 12.7 percent on year to 46.1 billion won.

Industry watchers noted that most of the company’s profits likely had come from the exclusive CMO contract for Nuvaxovid’s Covid-19 vaccine.

However, SKYCovione is expected to improve the company’s outlook in 2023 with a 200 billion won contract with the Korea Disease Control and Prevention Agency (KDCA). In addition, the company plans to apply to WHO and the European Medicines Agency for global approval.

The diagnostic kit makers fared relatively poorly in the second quarter.

Molecular diagnostic giant, Seegene, suffered an 11 percent drop in sales in the first half year, with 579.9 billion won. Its operating profit fell at an even steeper rate of 37 percent to 212.7 billion won.

Seegene plans to strengthen its sales strategy for PCR reagents with its All-in-One system (AIOS), which can be applied to various diagnostic reagents. Covid-19 no doubt positively influenced the markets in the first quarter. Still, the ease of Covid-19 rules in the second quarter negatively affected the markets, with most domestic and global Covid-19 kit makers experiencing a similar downturn.

Still, SD Biosensor managed to minimize the impact through mergers and acquisitions of Germany’s Bestbion and the U.S. Meridian Bioscience.

Korea’s medical AI industry showed promising signs. Lunit, one of Korea’s medical AI startups, recorded 5.48 billion won in sales in the first half-year, attaining 82.5 percent of its total revenue in 2021 thanks to the brisk sales of its flagship products, Lunit INSIGHT, and Lunit SCOPE. However, its operating profits were not available.

In terms of operating profit change, Daewoong showed the largest jump in the second quarter thanks to the robust sales of Nabota botulinum products, while Seegene showed the least satisfactory result.