Bioindustry analyst experts predicted that mergers and acquisitions (M&A) will play a central role next for the bioindustry at a seminar on bioindustry trends on Tuesday hosted by KoreaBIO, an association of local biotech firms.

The seminar took a look at the global healthcare growth opportunities in 2023, the present and future of Korean biopharmaceutical companies, the Kosdaq and Konex listing trends, and global bioindustry investment trends.

"The industry's weak investor sentiment, increased clinical costs, corporate restructuring, and pipeline reorganization are increasing interest in M&A," KoreaBIO’s head of bioeconomic research Oh Ji-hwan explained.

A Deloitte industry analyst echoed similar sentiments saying bio companies will be reevaluated in the investment market, centered on strategic investor-led M&As.

He went on to say that securing source technologies and intellectual property (IP) will become more important as the bioindustry shifts focus to biotechnology and specific disease management from new drugs with commercial success and away from pipeline developments.

He also mentioned that during the Covid-19 period, large global pharmaceutical companies’ cash reserves reached an all-time high of $21.4 billion (27.5 trillion won) according to last year’s figures, and Korean companies were among them.

Meanwhile, other bioindustry experts highlighted information management systems linked to medical and IT, robot surgery, wearable devices, AI-based diagnosis, ADC antibody treatment, and field diagnosis devices as key fields to drive global healthcare market expansion.

Accordingly, adjusting pipelines in case investment sentiment does not recover next year, was recommended.

Evaluate Vantage also noted that bio companies need to deliver clinical successes to reassure investors in its 2023 outlook.

The report highlighted Eisai and Lilly to reinvigorate the Alzheimer’s disease market, taking over from Biogen’s failures.

Meanwhile, the respiratory syncytial virus field's exploding popularity, together with the emerging gene therapy field, was expected to gain the confidence of regulators, the report said.

Despite the grim investment opportunities presented in 2022, Evaluate Vantage predicted an uptick in FDA approvals next year.

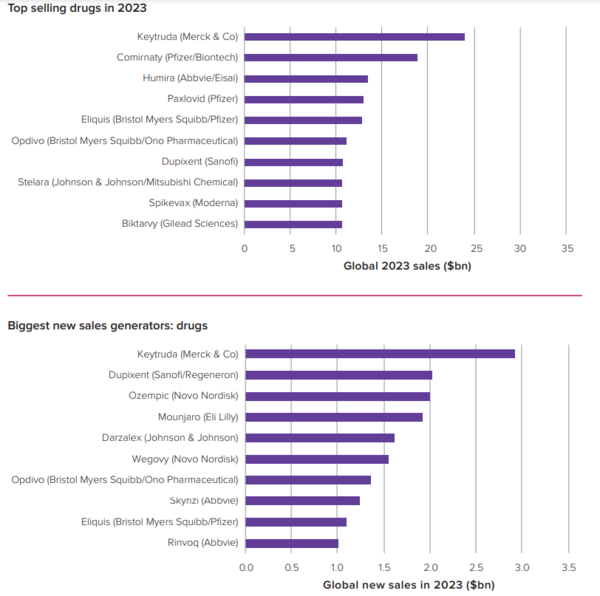

Monoclonal antibodies (mAbs) and vaccines are expected to lead both the best-selling drugs in annual revenues and new sales generators for 2023. This places Merck’s Keytruda, a PD-1 checkpoint inhibitor, at the top with 38 approved indications and 18 tumor types. As a result, Merck is projected to accumulate $3 billion (3.8 trillion won) in new sales next year, snatching the top spot from Pfizer’s Comirnaty Covid-19 vaccine.

However, the Covid-19 products remain uncertain based on the fluctuating pandemic situation which showed a declining trend for these products in 2022. Still, cumulative sales of Comirnaty and the Covid antiviral Paxlovid are expected to keep Pfizer as the top performing company in 2023 with more than $70 billion forecasted.

Lastly, the analysis of the fastest growing companies by Evaluate Pharma brings Novo Nordisk and Lilly to the top of the table due to the high demand for its type 2 diabetes and obesity agents of Ozempic, Wegovy, and Mounjaro.