Korea Biomedical Review is publishing a series of articles to analyze the top 10 Korean pharmaceutical and biopharma companies with the largest market capitalizations listed on the main bourse, Kospi, and the tech-heavy Kosdaq. The series aims to reflect key industrial issues and the flow of the capital market in the Korean pharmaceutical and biopharma industry. This is the first installment. -- Ed.

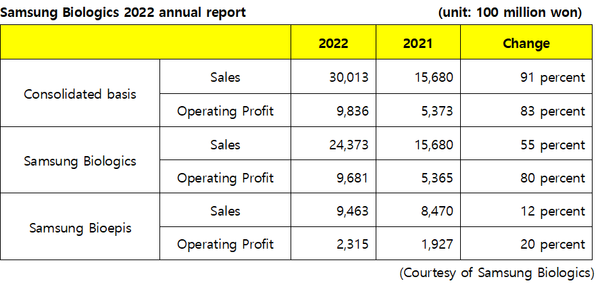

Samsung Biologics posted record-breaking performance in 2022, exceeding 3 trillion won ($2.43 billion) for the first time for a Korean biopharmaceutical company, despite economic crises such as global inflation. Operating profit also approached 1 trillion won.

Notably, the company exceeded sales of 2 trillion won in two years after achieving 1 trillion won in 2020.

The company stressed that the boost in sales was thanks to the expansion of new orders, increased plant utilization, and external expansion following the incorporation of Samsung Bioepis as a wholly-owned subsidiary.

While Samsung Biologics recorded phenomenal growth to become the first biopharmaceutical company to surpass 3 trillion won in sales, the company has strong plans for continued growth.

The company's CEO John Rim recently highlighted such plans during the 2023 J.P. Morgan Healthcare (JPM) Conference held from Jan. 9 to 12.

During the "Main Track" session at the 2023 JPM Healthcare Conference, Rim stressed that the company is solidifying its position as the world's largest CMO provider by completing the fourth factory in addition to the existing three plants in Songdo, Incheon.

"When completed, the plant will have the world's largest production capacity of 240,000 kiloliters of biopharmaceuticals," CEO John Rim said. "When combining the production capacity of the first (30,000 kL), second (154,000 kL), third (180,000 kL), and fourth plant, Samsung Biologics has the world's biggest production capacity of 604,000 liters."

However, Rim stressed that the company does not plan to stop with the fourth plant and build a second Bio Campus to expand its capacity further.

"The site for the second Bio Campus has already been secured," Rim said. "Samsung Biologics will invest 7.5 trillion won in the second Bio Campus to create a large-scale biopharmaceutical production facility and build an open innovation center to nurture new drug development startups."

On top of expanding production capacity, Samsung Biologics is also diversifying its production items.

With mRNA attracting attention after Pfizer and Moderna developed Covid-19 mRNA vaccines, Samsung Biologics plans to expand its expertise for mRNA drugs and vaccines.

Samsung Biologics completed the construction of its mRNA drug substance production facilities in May 2022 and succeeded in test production of Covid-19 mRNA vaccine candidates for Greenlight Biosciences, a U.S. pharmaceutical company, in August of the same year.

By securing the mRNA production facility, the company expects that it will be able to win contracts for CMO from global pharmaceutical companies that are developing mRNA drug or vaccine candidates.

Samsung Biologics also pays attention to new drugs, such as cell gene therapy and antibody-drug conjugates (ADC).

The company is preparing production facilities to produce antibody drug conjugates in the first quarter of 2024.

During the recent JPM Healthcare Conference, CEO Rim stressed that the company plans to mass-produce ADCs under consignment, conduct CDO for bioventures developing ADC treatments, and invest in promising ADC new drug development companies.

The company will also be expanding its CDO business, which was considered weak compared to its CMO operation.

To grow the CDO business, the company recently launched S-DUAL, a next-generation bispecific antibody platform with improved stability and binding ability with an asymmetric structure similar to human antibodies, and DEVELOPICK, a technology for screening new drug candidates.

Notably, Samsung Biologics expects that it will be able to further strengthen its end-to-end service from CDO to CMO by additionally providing S-DUAL service to its bispecific antibody CMO know-how it has accumulated so far.

Synergy with Samsung Bioepis

Samsung Biologics also expects sales growth outside its CDMO this year.

Samsung Bioepis, incorporated as a wholly-owned subsidiary of Samsung Biologics in 2022, may see a huge boost in sales due to the launch of Hadlima, its Humira biosimilar, in the U.S. market this year.

Humira inhibits the cytokine tumor necrosis factor (TNF). The U.S. Food and Drug Administration (FDA) first approved Humira to treat rheumatoid arthritis in December 2002. Since then, Humira has sequentially secured indications for nine autoimmune diseases.

Humira is a mega-blockbuster drug that has held the top sales spot among all pharmaceuticals for nine consecutive years since 2012.

Sales of Humira in the third quarter of last year were $4.956 billion, up 7.4 percent from the same period last year ($4.613 billion).

Samsung Bioepis' U.S. partner Organon is set to release Hadlima in July.

A rosy outlook for Samsung Biologics

With Samsung Biologics continuing to expand its sales top line, stock market analysts expect Samsung Biologics' share price will continue to rise this year.

Kang Ha-na, an eBest Investment & Securities analyst, said her brokerage maintained a "buy" opinion on Samsung Biologics with a target price of 1.1 million won.

Kang cited the expansion of the biosimilar market and preparations for Alzheimer's antibody treatment and mRNA production in 2023 and expectations for overseas factory expansion as reasons for the target price.

Meritz Securities analyst Park Song-yi agreed.

Park stressed that her brokerage maintained a "buy" opinion on Samsung Biologics with a target price of 1.2 million won.

However, to maintain growth, Park stressed that it would be important for Samsung Biologics to preoccupy the market for Humira biosimilar with Hadlima and rapid increase in the operating rate of the Samsung Biologics' fourth plant and concrete construction details of the fifth plant as perquisites.

Related articles

- [Top K-Pharma Analysis ②] LG Chem's life science division aims to achieve ₩1 tril. sales in 2023

- What’s the solution for CDMO manpower shortage amid Samsung vs Lotte rivalry?

- 'Samsung Biologics asks Lotte Biologics to stop employee poaching'

- [Top K-Pharma Analysis ③] 'Celltrion to see a decrease in operating profit in 2022, but still an attractive stock option for investors’

- [Top K-Pharma Analysis ④] SK Bioscience faces trouble as sales, operating profit fall drastically in 2022

- [Top K-Pharma Analysis ⑤] Yuhan goes all-in in new drug R&D, despite profit decline

- Pfizer inks $183 million CMO deal with Samsung Biologics

- [Top K-Pharma Analysis ⑥] Hanmi Pharmaceutical continues focus on R&D investment as it celebrates in 50th anniversary

- [Top K-Pharma Analysis ⑦] SD Biosensor's operating profit deteriorates as Covid-19 pandemic calms down

- Samsung Biologics to pour ₩1.9 trillion into building 5th plant

- [Top K-Pharma Analysis ⑧] GC’s 2022 earnings expected to be largest in company's history

- [Top K-Pharma Analysis ⑨] Chong Kun Dang’s earnings solid, despite betting big on new drug R&D

- [Top K-Pharma Analysis ⑩] Analysts paint rosy picture for Cosmax, citing recovery in Chinese demand

- [Top K-Pharma Analysis ⑪] HLB needs to start showing results

- [Top K-Pharma Analysis ⑫] Alteogen to start reaping benefits from its licensing agreements

- [Top K-Pharma Analysis ⑬] Caregen bullish on 2023 sales, targets more than double growth

- [Top K-Pharma Analysis ⑭] Medytox's market cap doubles in 4 months

- [Top K-Pharma Analysis ⑮] ST Pharm turns from white elephant to cash cow for Dong-A Socio Holdings

- [Top K-Pharma Analysis ⑯] Hugel accelerates global expansion following record-breaking sales