Large traditional Korean pharmaceutical companies, such as Chong Kun Dang, Dong-A ST, and Samchundang Pharmaceutical, are accelerating their entry into the biosimilar market.

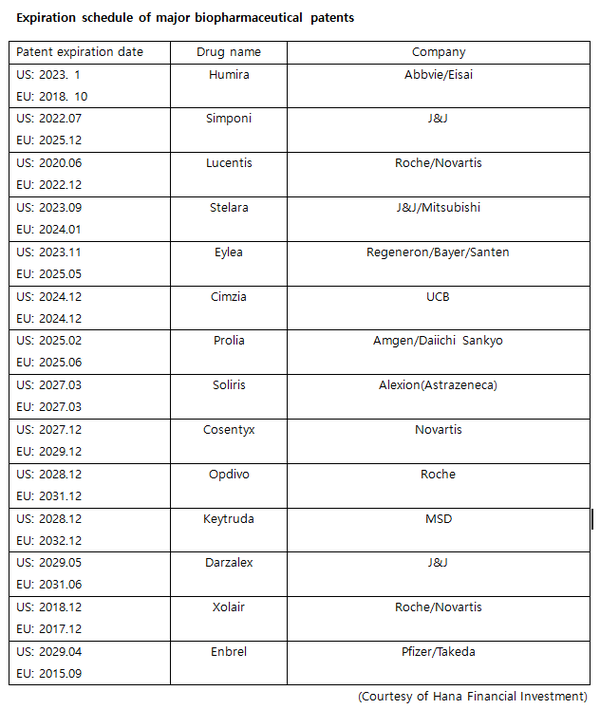

According to industry watchers, local pharmaceutical companies are zeroing in on the growth potential of biosimilars as blockbuster biopharmaceutical patents expire. The global biosimilar market is expected to grow to 92 trillion won by 2030 from 22 trillion won in 2020, according to IQVIA.

Chong Kun Dang

Chong Kun Dang received approval for two biosimilars -- Nesbell (ingredient: darbepoetin alpha), a biosimilar treatment referencing Nesp, in 2018 and LusenBS (ingredient: ranibizumab), a biosimilar referencing Lucentis, in 2022.

Nesp, co-developed by Japan's Kyowa Hakko Kirin and Amgen, treats anemia of chronic disease associated with cancer. After the launch of Nesbell in Korea and Japan, Chong Kun Dang has also entered three Southeast Asian countries -- Taiwan, Vietnam, and Thailand -- and six Middle Eastern countries -- Oman, Saudi Arabia, UAE, Kuwait, Qatar, and Bahrain.

Chong Kun Dang is also preparing to launch its second biosimilar LusenBS that treats macular degeneration.

Chong Kun Dang aims to target the Korean market for ranibizumab worth 32 billion won and Southeast Asia and the Middle East, which is worth about 200 billion won.

Dong-A ST

Dong-A ST is pursuing external expansion with biosimilars in Japan.

In 2014, Dong-A ST signed an out-license agreement with Japan's Sanwa Kagaku Kenkyusho (SKK) for the development and sales of Nesp's biosimilar DA-3880 in Japan.

After obtaining approval for manufacturing and sales in Japan in 2019, DA-3880 successfully settled in the Japanese biosimilar market, achieving sales of 8 billion won in 2020 and 12.5 billion won in 2021.

In addition, the company signed an exclusive technology transfer and supply contract for DA-3880 with Polifarma, a Turkish pharmaceutical company, in November of last year.

Under the agreement, Dong-A ST will transfer exclusive development and sales rights for DA-3880 to Polypharma in Turkey, Brazil, and Mexico.

Dong-A ST is also focusing on additional biosimilar development.

Dong-A ST completed the global phase 3 clinical trial of Stelara biosimilar DMB-3115 (ingredient: ustekinumab) in November last year.

Stelara is a treatment for inflammatory diseases such as Crohn's disease, ulcerative colitis, plaque psoriasis, and psoriatic arthritis. It is one of the highest-grossing biopharmaceuticals recording $16.8 billion (20.7 trillion won) in sales worldwide in the third quarter of 2022.

The patent for Stelara will expire in the U.S. in September 2023 and EU in January 2024.

DMB-3115 global phase 3 was conducted for 52 weeks with a total of 605 patients in nine countries, including the U.S., Poland, Estonia, and Latvia.

Dong-A ST plans to apply for product approval of DMB-3115 in the U.S. and Europe in the first half of this year after completing the analysis of the phase 3 clinical trial and securing positive data.

Sam Chun Dang Pharmaceutical

Sam Chun Dang Pharmaceutical completed the global phase 3 trial of SCD411 (ingredient aflibercept), a biosimilar referencing Eylea, in the third quarter of last year.

Eyela is a macular degeneration treatment. The substance patents for Eyela are scheduled to expire in June 2023 and May 2025 in the U.S. and Europe, respectively.

Sam Chun Dang plans to receive permission first in Japan, and then apply for permission sequentially in the U.S., Korea, and Europe.

Industry watchers expect biosimilar competition will intensify as more patents of blockbuster antibody drugs will expire in the next few years.

Patents for Cimzia, an autoimmune disease treatment developed by UCB, will expire in 2024, and patents for Prolia, a preventive treatment for osteoporosis and cancer-related skeletal complications developed by Amgen and Daiichi Sankyo, will expire in 2025.

Related articles

- HK inno.N licenses in mAbxience's denosumab biosimilar

- Samsung Bioepis, Chong Kun Dang to compete for Lucentis biosimilar market share in Korea

- Dong-A ST’s Stelara biosimilar shows equivalence in global phase 3 study

- Humira's US patent expiry heats up biosimilar competition

- Biosimilars gain traction in the Korean drug market

- Sam Chun Dang Pharm licenses out Eylea biosimilar to Canadian company in $15 mil. deal

- Sam Chun Dang Pharm inks deal to supply Eylea biosimilar to 9 European countries