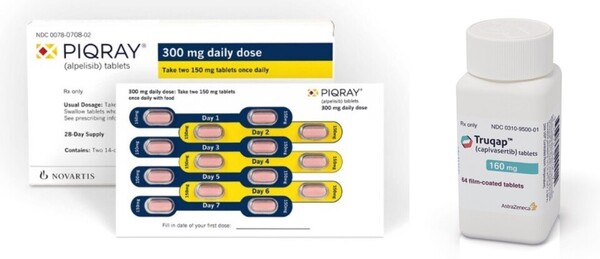

Novartis' PI3K-inhibiting breast cancer drug Piqray (alpelisib) has been struggling in the Korean market, failing to gain access to health insurance coverage.

In the meantime, AstraZeneca recently launched a process to win approval in Korea with its FDA-approved AKT inhibitor, capivasertib (Truqap in the U.S.), drawing the industry’s attention.

In the pivotal phase 3 CAPItello-291 study, capivasertib demonstrated efficacy in patients previously treated with CDK4/6 inhibitors. In particular, industry insiders said it could reduce the risk of hyperglycemic side effects and toxicity associated with Piqray.

Recently, AstraZeneca has set about in earnest to win a nod for capivasertib in Korea.

Capivasertib is a first-in-class AKT inhibitor approved by the U.S. Food and Drug Administration for the second-line treatment of patients with locally advanced or metastatic HR+/HER- breast cancer harboring one or more of the PIK3CA/AKT1/PTEN mutations in combination with fulvestrant.

Endocrine-resistant tumor cells often exhibit aberrant AKT signaling through the PI3K-AKT-PTEN pathway, and capivasertib, a broad-spectrum AKT kinase inhibitor, blocks this signaling pathway, resulting in anti-proliferative effects and synergistic effects with endocrine therapy.

In the CAPItello-291 study, which was the basis for the U.S. approval, capivasertib combined with fulvestrant doubled progression-free survival compared to fulvestrant alone.

The study, which involved 708 patients, included patients with and without AKT pathway alterations (41 percent), and more than half of the patients (69 percent) had received a CDK4/6 inhibitor in prior therapy.

Among the 289 patients with PIK3CA/AKT1/PTEN mutations, the median progression-free survival (mPFS) of the capivasertib plus fulvestrant arm was 7.3 months, compared with 3.1 months in the control arm, reducing the risk of disease progression or death by 50 percent.

The PFS hazard ratio (HR) of 0.60 in the capivasertib arm compared to the control arm was also significant across all patients. However, an exploratory analysis of the effect in patients without PIK3CA/AKT1/PTEN mutations (44 percent) reduced the benefit to a PFS hazard ratio of 0.79, suggesting that the improvement in all patients was mostly driven by patients with PIK3CA/AKT1/PTEN mutations.

The most frequent adverse events with grade 3 or higher in capivasertib were rash (12.1 percent vs. 0.3 percent for placebo) and diarrhea (9.3 percent vs. 0.3 percent for placebo). Patients in the capivasertib arm also maintained their overall health status and quality of life from baseline longer.

Meanwhile, after the results of the CAPItello-291 study became public, cancer experts took note of the safety profile of capivasertib.

When the CAPItello-291 study was published in the New England Journal of Medicine (NEJM) in early June, William J. Gradishar, M.D., editor-in-chief of hematology/oncology, highlighted the study in a separate review, NEJM Journal Watch, saying, “Capivasertib could be another partner for endocrine therapy after CDK4/6 inhibitor treatment."

He noted that while the combination of alpelisib (Piqray) and fulvestrant can be used to treat patients with PIK3CA mutations, caprivasertib has a better toxicity profile than alpelisib and appears to be effective in patients without mutations in the AKT pathway.

A potential benefit of capivasertib's toxicity profile is a lower incidence of "hyperglycemia," typically associated with PI3K inhibitors like Piqray, Gradishar added.

Because insulin signaling is mediated through the PI3K pathway, blocking this pathway can lead to relative insulin resistance and hyperglycemia. So, the development of the next generation of PI3K inhibitors since Piqray has focused on increasing selectivity and reducing the incidence of hyperglycemia.

Moreover, the pivotal trial of capivasertib includes many patients on CDK4/6 inhibitors, giving it an advantage over Piqray.

In the case of Piqray, when the pivotal phase 3 trial was designed, CDK4/6 inhibitors were not being used as the standard of care in the first-line setting, making it difficult to include patients previously treated with CDK4/6 inhibitors in the study.

The problem was that since Piqray was commercialized, concerns have been raised about whether it would reproduce the same efficacy as phase 3, which results in a changed clinical setting where CDK4/6 inhibitors are now the first-line standard of care.

When Piqray was introduced in Korea in 2021, it was also the reason cancer specialists offered gloomy forecasts for its reimbursement. Piqray has yet to enter the reimbursement list more than two years after getting approval from the Ministry of Food and Drug Safety.

Under these circumstances, the introduction of capivasertip in Korea has further darkened the prospects of Piqray in the Korean market.

According to ClinicalTrials.gov, a U.S. clinical trial information site, the CAPItello-291 study of capivasertib includes Korean patients, and the expectations of breast cancer experts who have used capivasertib are also rising.

At the same time, AstraZeneca's presence in breast cancer treatment is expected to grow.

In addition to fulvestrant (Faslodex in brand name) for HR+ patients, AstraZeneca has the PARP inhibitor Lynparza (olaparib) for treating BRCA-mutated breast cancer.

More recently, the company has expanded its reach beyond HER2-positive patients to HER2 low-expressing patients with the antibody-drug conjugate (ADC) Enhertu (trastuzumab deruxtecan), which is being co-developed with Daiichi Sankyo, and another, datopotamab deruxtecan (Dato-DXd), is nearing launch in triple-negative breast cancer.

In addition, capivasertib, camizestrant, and oral selective estrogen receptor downregulators (SERD) have added strength to the treatment of HR+ patients and are expected to expand their role across all breast cancer subtypes.