ITC ruling to affect Allergan’s US market share ②

Why did Allergan team up with Medytox?

Medytox and Allergan became partner firms in 2013 when Medytox licensed out Innotox, a liquid BTX agent, to Allergan. The massive deal worth $362 million, including an upfront payment of $65 million, was a rare case for a Korean drugmaker.

The agreement drew attention, particularly because it proved a Korean BTX product’s potential to sell in the U.S. market. The deal allowed Allergan to conduct a phase-3 trial on Innotox in the U.S., Medytox to manufacture the product after commercialization, and give Allergan exclusive marketing rights around the globe, except for Korea.

After the deal, Medytox also announced that it would push its powdered BTX agent, Meditoxin, to enter the U.S. to compete against Allergan’s Botox directly.

Daewoong Pharmaceutical also signed a licensing-out deal with Evolus in 2013, officially announcing its plan to enter the U.S. BTX market. Under the agreement, Evolus was to be in charge of Jeuveau’s trial procedures in the U.S. and Europe, and Daewoong was to obtain the license to supply finished products for the U.S. market for five years.

Now, after seven years, Daewoong obtained the FDA’s approval for Jeuveau and is selling the product. However, Medytox has failed to win the nod, for both Innotox and Meditoxin, although the company was faster than Daewoong to develop the drug and signed the deal with Allergan, the global leader of the BTX market.

Some industry sources in Korea raised suspicion that Allergan might have signed the licensing deal with Medytox to maintain its dominance in the U.S. market and that Allergan was allegedly behind the Medytox’s lawsuits against Daewoong in the U.S.

Is Allergan using ITC case as defense?

The sources attributed such a suspicion to the U.S. market situation where Allergan has a near-monopolistic status.

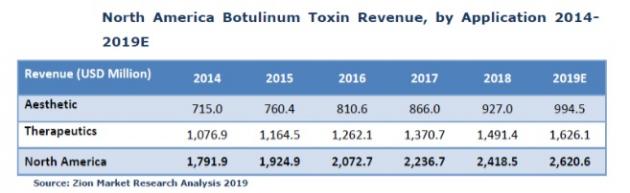

The world’s BTX market was estimated to be $4.9 billion as of 2019, and Allergan had about a 70 percent market share. The company also has a similar share in the U.S. BTX market, the largest in the world. Allergan was mired in a class-action lawsuit for allegedly breaching the antitrust law in 2015, and the company in 2018 decided to pay $13 million settlement, instead of releasing Innotox, to keep its market dominance.

In 2018, Allergan announced its plan to commercialize Innotox by 2022 and develop a subcutaneous BTX injection, an upgraded version of Innotox. Observers in Korea suspected that Allergan might have intentionally neglected the Medytox’s technology to keep its monopolistic status and developed a liquid BTX product separately.

However, Daewoong’s release of Jeuveau threatened Allergan’s No. 1 position. Jeuveau is just one of the latecomer rivals, such as Ipsen’s Dysport and Merz’s Xeomin. However, observers regarded Jeuveau as a threat to Botox because of several reasons -- physicians can easily switch from Botox to Jeuveau; Jeuveau is cheaper; and Evolus, the seller of Jeuveau, has key members from the American Society of Plastic Surgeons.

In less than one year after the market release, Jeuveau had the third-largest market share in the U.S., according to Daewoong.

Jeuveau likely to target more US patients

The arrival of Jeuveau in the U.S. is likely to not only affect the market of cosmetics and plastic surgery.

Although Jeuveau does not have an indication for strabismus or polio, the same ingredient and the same dose are used for treatment purposes. If Jeuveau secures a larger market share, U.S. patients, doctors, and insurers will be tempted to use a cheaper product. A price reduction in the BTX market is likely to affect Allergan’s overall revenue.

However, Allergan has no tool to put brakes directly on Daewoong’s entry in the U.S. BTX market, and this is why Medytox’s suit against Daewoong with the International Trade Commission (ITC) is a battle between Allergan and Daewoong, observers said.