A labor leader has accused some multinational pharmaceutical firms’ executives of misusing company funds at an open debate, causing a stir in the pharmaceutical industry.

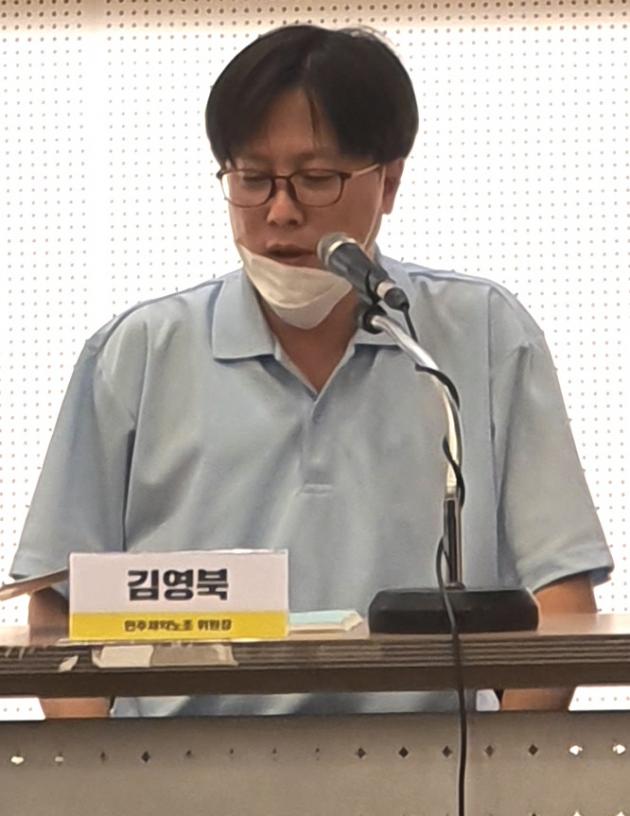

Kim Young-buk, head of Korea Democratic Pharmaceutical Union (KDPU), made such remarks during the "Discussion to Improve Labor-Management Relations of Multinational Enterprises" session, held at the National Assembly Library on Tuesday.

Kim claimed that some multinational pharmaceutical executives are receiving kickbacks to fill their pockets or send them to the company's headquarters.

Kim said such opaque funds are the fundamental reason for the poor labor-management relations at multinational pharmaceutical companies.

"Multinational corporations usually say that their top priority is the interest of shareholders," Kim said. “However, the shareholders of multinational corporations in Korea only consist of such firms' head office. Therefore, the main purpose of Korean subsidiaries is to send as much money as possible to their head office.”

Kim stressed that while the company handles various other expenses, such as worker's pay and organizes financial statements with the remaining funds, the company's workers do not know how the money is used in detail.

"Such a structure makes it possible for headquarters to control the Korean offshoots’ sales or profits," Kim said. "Thus, financial profits workers see on balance sheets are meaningless."

That also explains why multinational pharmaceutical firms make incomprehensible decisions, such as restructuring, even when the firm is making a profit, Kim said, noting that they need to lower costs and increase profits to send to the head office,

Notably, Kim claimed that money meant for use inside the company was flowing into the “back pockets” of management through illegal means.

Kim cited kickbacks as one of such typical methods.

"When the company purchases a certain product, it buys the product through an agency, which excessively charges the company for the purchase," Kim said. "Afterward, the agency returns 20 to 30 percent of the margin to the management."

According to Kim, such behaviors were frequent during hotel meals and meetings involving the company and overseas travels by employees.

"The related travel agency sends a statement in excess of the actual cost. If the company pays according to the statement, the agency then returns a portion of the margin to the management as a reward," Kim claimed. "Nowadays, with the development of the Internet, the price of package travel is almost the same. When we go on company trips, however, it is always more expensive than what we see online, while some companies require employees to pay travel taxes."

According to the union’s finding, all this was because the fee was too small as a kickback for the management. So the remaining budget, which was set as an incentive, was used for tax processing reasons to give managers more kickbacks.

By using the incentive budget, which could have been given to the employees, in such a manner, managers could receive a bigger kickback, Kim claimed.

The union head also said that kickbacks exist in the sale of products, consignment sales, and co-marketing contracts.

"Drugs need lots of initial marketing costs. As time goes on, however, the cost falls, and the prescription sales increase even if it does not take any actions," he said. "Therefore, profits are bound to increase, but managers sell off these products to others."

As it turns out, there was a kickback in selling the medicine as well, he added.

Kim claimed that because managers also are wage earners, they get kickbacks by selling drugs.

"Companies can sell drugs through their marketing reps. To get the kickback, however, they take other steps, such as selling off medicines to another company, or sign a consignment or co-marketing agreement," Kim said.

According to Kim, kickbacks also exist during leasing office spaces.

"Ten years ago, multinational pharmaceutical companies in Teheran-ro or Seocho-dong in southern Seoul, notorious for the high real-estate price, moved their offices to less expensive Songpa-gu or Hanam to reduce fixed costs," Kim said. "In recent years, however, they have started to return to areas with high real-estate prices even though the companies claim that their financial situations are dire."

Later, the union confirmed that the rent was overblown by the agency in charge of the move, and several years of rent management fees were flown back to the CEO, he added.

Kim went on to say that the company was buying an excessive amount of expensive office equipment during the move.

"A company that refused to raise 300,000 to 400,000 won ($250-330) monthly wage for employees, also purchased chairs worth 1.2 million won for all employees," he said. "Through this kickback, the pockets of the head office or Korean corporate executives were filled. Workers had to bear the brunt of its aftermath, as the company announced withdrawal from Korea or restructuring."

To resolve such problems, Kim called for legislation, strengthening the penalties if the labor-management council fails to report the company's finances.

"To ensure a transparent flow of funds, it is necessary to make a law that mandates the disclosure of financial statements during the labor-management talks whether they are limited liability companies or limited joint ventures," Kim said. "Also, establishing a compensation system for whistleblowers is needed."

Finally, if the company is fined for tax evasion or omission, the government should keep the fines and use it to help its employees if the company withdraws or carries out restructuring, he added.