Antibody-Drug Conjugates (ADCs), which drew attention by supplementing existing drugs’ shortcomings, have emerged as a major new anticancer drug platform, recording a market growth rate of 22 percent.

Korea Drug Development Fund (KDDF) released a report on the global trend of new drug development concerning ADC on Thursday.

“AstraZeneca-Daiichi Sankyo’s Enhertu (trastuzumab-deruxetecan) and Gilead’s Trodelvy (sacituzumab-govitecan) demonstrated new treatment options and the possibility of paradigm change in treating metastatic breast cancer by presenting significant clinical advantages against the standard therapy through phase 3 clinical trial this year, raising interest in developing ADCs as anticancer treatments,” KDDF researcher Jin Ju-youn said in the report.

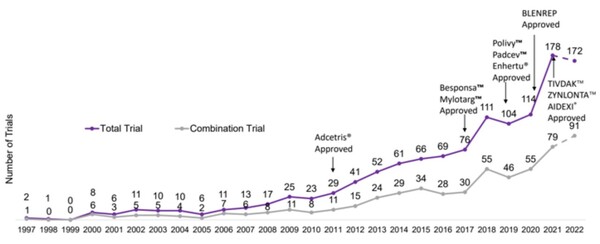

Since Pfizer’s Mylotarg (gemtuzumab-ozogamicin) won approval for the first time in 2000, 12 ADC drugs have won the nod from the U.S. Food and Drug Administration, including Takeda’s Adcetris (brentuximab-vedotin) in 2011 and ImmunoGen’s Elahere (mirvetuximab-soravtansine) in 2022.

According to Grand View Research, ADC drugs’ global market is estimated to grow an estimated 22 percent on an annual average, from $5.81 billion (7.59 trillion won) in 2022 to $13 billion (16.98 trillion won) in 2026.

Among the 82 clinical studies of ADC drugs targeting existing tumors registered in Clinicaltrials.gov in 2021, more than 80 percent were the initial 1/2 clinical phases conducted on solid tumors. By tumor type, HER2 targets were last in number, with 17 accounting for 20.7 percent,

In the first half of 2022, global ADC research and development projects totaled 864, including 427 (49 percent) pre-clinical studies, 143 (17 percent) clinical studies, and 13 (2 percent) approved drugs. Aside from 12 approved by the U.S. FDA, the figure includes India’s Kadcyla biosimilar, Uzvira (trastuzumab-emtansine).

ADCs’ clinical trials began to surge in 2010. In the first half of this year, 172 studies were underway, including 91 combination therapies.

ADC drug’s share in the global pipelines of the top-10 companies in research and development stood at 3 percent, 38 of the total 1,148 in 2021. However, tech transfers to secure ADCs are being made briskly by Johnson & Johnson, Eli Lilly, and GSK.

The global pharmaceutical companies in the top-10 R&D investor list in 2021 were Roche, J & J, Pfizer, MSD, BMS, AstraZeneca, Novartis, GSK, AbbVie, and Eli Lilly.