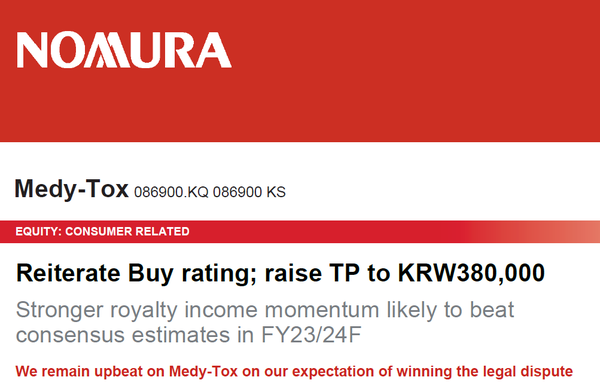

Nomura Securities recently raised its price target for Medytox to 380,000 won ($298), a 44.8 percent increase from the previous target of 280,000 won, citing “optimism” for legal dispute settlement.

However, industry watchers said the securities company failed to provide evidence to support such claims.

Nomura analyst Cara Song said the royalty revenue of Medytox, one of the leading botulinum toxin (BTX) makers, will more than quadruple when the company settles its legal disputes with its rivals Daewoong Pharmaceutical and Huge.

However, Song did not provide any backup evidence on why they believed that Medytox will be able to settle both lawsuits.

Nomura raised its 2024 and 2025 royalty income estimates for Medytox as it now includes competitors' exports of BTX sales for its legitimate base for royalty income.

"We believe our previous assumption, which factored in only domestic-only Botox sales, was conservative, as Botox production will be stopped for both domestic sales and exports if Medytox settles the legal dispute with both Hugel (at U.S. ITC) and Daewoong Pharma (at Korean civil court)," Song said. "In the end, we maintain ‘Buy’ on Medytox and lift the sum of the parts (SOTP)-based target price to 380,000 won, as we reflect 100 percent probability of reaching settlements with both Daewoong and Hugel."

The litigations refer to the ongoing investigation from the U.S. International Trade Commission regarding Medytox's claims that Hugel allegedly stole its BTX technology and a local civil court trial that is looking into similar claims made by Medytox against Daewoong.

In addition to the ongoing litigation, Song highlighted the fact that the new target price also reflects the business value of MT10109L, Medytox's non-animal liquid toxin formulation, which is currently preparing to enter the U.S. market.

"Medytox plans to submit BLA (biological license application) for MT10109L for U.S. FDA approval in the second half of this year and plans to enter the U.S. market by the end of this year," Song said. "The company will also apply for the UAE approval for MT10109L in the second half of this year, which will be another important catalyst for the share price, in our view."

Downside risks for Medytox included unfavorable foreign currency exchange, negative consumer sentiment affecting earnings this year, and losing its lawsuit with Daewoong and Hugel, Song said.

In response to Nomura’s forecast, both Hugel and Daewoong firmly stated that they have no intention of resolving their lawsuits with Medytox.

A Hugel spokesperson said, "We have refrained from making any comments regarding the ITC case involving Medytox. Consequently, we are unaware of the evidence Nomura utilized to support such assertions."

Likewise, Daewoong vehemently denied the notion of engaging in a settlement agreement with Medytox, deeming it entirely false and absurd.

"We are uncertain about the basis on which Nomura has formulated these claims," an official at Daewoong said.

Related articles

- [Top K-Pharma Analysis ⑭] Medytox's market cap doubles in 4 months

- Daewoong to invest ₩100 billion to build 3rd plant for Nabota

- Prosecutors indict Hugel, Medytox for allegedly selling botulinum toxin illegally

- Shares of Medytox drop as Hugel files for patent invalidation

- Medytox's UAE partner conducts due diligence on Medytox's Osong plant

- Daewoong seeks suspension of execution regarding the recent BTX origin ruling

- Medytox-Daewoong battle causes ripple across BTX industry

- Hugel completes polydioxanone suture brand launch seminar in Thailand

- Regulator, Medytox enter 2nd round of legal battle on 'indirect export' of BTX