The U.S. initial public offering (IPO) market is showing signs of recovery this year, drawing attention to the U.S. expansion of Korean bio companies.

Notably, Celltrion Chairman Seo Jung-jin had announced in Janauary his plans to list Celltrion Holdings, the parent company Celltrion Inc., on the Nasdaq market.

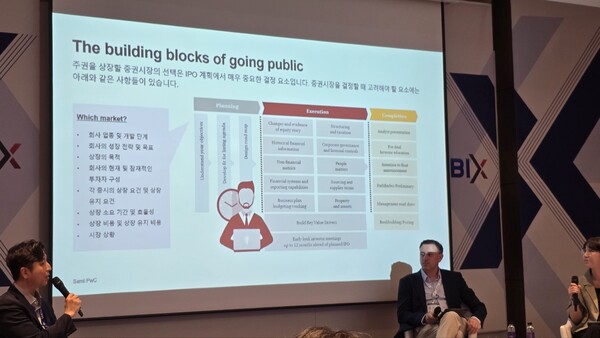

At the Bioplus-Interphex (BIX) Korea 2024 conference held on Thursday at COEX in Gangnam, Seoul, industry leaders discussed trends and opportunities in the global IPO market.

The session, chaired by Nam Seung-su, featured panelists Daniel Fertig and Jeong Seung-won. The three are all Global IPO Partners at Samil PwC.

Fertig kicked off the discussion by noting that the current environment is favorable for companies considering an IPO in the U.S., citing rising expectations of a U.S. interest rate cut.

Attendees highlighted the growing interest of bio companies in listing on U.S. markets, discussing the unique characteristics and considerations of different markets.

Jeong emphasized the significant role of the U.S. market, especially considering the high value placed on FDA approvals.

However, she also cautioned that entering overseas markets requires the assistance of local advisors, and the complexity and cost can be high, while listing in Korea offers familiarity with regulations and lower costs.

Jeong advised companies aiming for U.S. listings to consider Special Purpose Acquisition Company (SPAC) listings as a viable option, despite potential challenges in aligning interests between SPAC sponsors and shareholders.

"When aiming for overseas markets, it's crucial to get help from advisors in the country where you plan to list," she explained. "Considering the costs, it's quite challenging."

On the other hand, the Korean market's familiarity with regulations and lower costs are significant advantages, she added.

Jeong mentioned NKMax's subsidiary, NKGen Biotech, as an example.

NKGen Biotech successfully listed on the Nasdaq through a merger with a SPAC last year, marking a first for a Kosdaq-listed Korean company to get listed on the U.S. stock exchange through such a method.

Yet, Jeong warned that SPAC listings could create short-term trading opportunities and might not always align with the business's long-term interests.

Jeong emphasized that pursuing a U.S. listing, due to difficulty with domestic listing, is not advisable, highlighting the importance of adapting financial statements to U.S. standards, which can be a complex and time-consuming process.

While the U.S. stock market, which constitutes 42 percent of the global market, offers high valuation ceilings and significant global activity potential, the hurdles remain substantial, she went on to say.

"These include high costs for listing and maintenance, as well as the risk of delisting if stock performance does not meet requirements," she said. "However, the volatility of U.S. markets poses significant challenges."

NKGen Biotech, for instance, experienced a decline in stock value, with its share price closing at $1.04 on Thursday.

Maintaining a Nasdaq listing requires a minimum share price of $1 over the preceding 30 trading days and a market value of at least $50 million. This example underscores the difficulties in sustaining a U.S. listing.

Nam echoed this sentiment, suggesting that companies should not view U.S. listing as a simpler alternative to domestic listing but rather integrate it into a broader strategic plan.

"Compared to Korea, listing in the U.S. incurs higher costs for sponsors and experts," he said. "While it's possible to list in the U.S. by spending more, it requires ongoing stock price management and other factors."