The targets are bold: Launch new products in the world’s most competitive markets. Sell more than 2,000 miLab -- digital microscopy-based diagnostic solution -- devices. Turn a profit before 2027. Secure multimillion-dollar contracts with global healthcare giants. Build at least two new R&D pipelines.

All within three years. By 2027, Noul aims to be a global digital healthcare company, capturing over 10 percent of the market in its industry.

So far, reality hasn’t caught up. Since its Kosdaq listing in 2022, Noul has sold just 135 miLab Platform devices—a fraction of its new target. Last year, the company reported 1.6 billion won ($1.1 million) in revenue, down 41.4 percent from the previous year, while its operating loss widened by 41.2 percent to 22.8 billion won.

Nearly all of that revenue came from miLab Cartridge MAL, a diagnostic cartridge for malaria, primarily serving a niche market in Africa.

Its valuation, by CEO David Lim’s own admission, “has not yet fully reflected” its potential.

Lim knows the odds. During a press conference held in Seoul on Wednesday, he got straight to the point. “The past 10 years of Noul were dedicated to developing the core technologies and business foundation for our innovative products,” he said. “The next 10 years will be about results.”

The malaria market, which has sustained Noul so far, is no longer enough. To compete globally, it needs to break into the biggest leagues of medical diagnostics: North America and Europe.

Lim believes it can. And he’s betting on timing and technology to make that happen.

The company is aiming to secure over 40 billion won in new sales contracts and expand its presence beyond Africa. By 2027, it expects its diagnostics business to be evenly split between emerging markets and key economies in Europe and North America. Germany, Italy, the U.K., and the U.S. are at the center of that push.

It’s an ambitious gambit, but it’s not baseless. For years, Noul has refined its technology, betting that automation can solve one of diagnostics’ biggest inefficiencies: time.

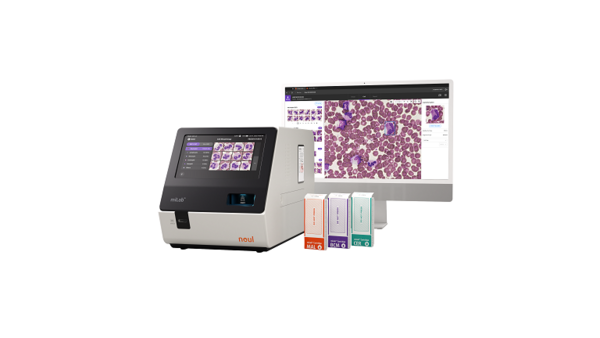

Its AI-powered flagship product, the miLab Platform, delivers lab-grade results in 15 to 20 minutes, using 80 percent less labor than traditional systems. Unlike conventional machines that require overnight batch processing, miLab operates in real time, a major advantage for hospitals under pressure to speed up diagnostics.

Lim believes the timing is right. Aging populations, rising cancer rates, and healthcare worker shortages are accelerating demand for automation. The World Health Organization is pushing to increase cervical cancer screening rates from 30 percent to 70 percent by 2030. Meanwhile, climate change is fueling the resurgence of malaria—even in regions that once eradicated it.

For Noul, Lim says these trends are an opening. But shifting from a niche malaria business to a broader diagnostics company is a major transition.

For now, malaria testing still accounts for 100 percent of Noul’s sales. To change that, the company has been expanding its European office, based in Switzerland’s Innovation Park Basel Area, hiring professionals in the U.K., France, and Germany to build direct relationships with hospitals and healthcare providers.

Still, selling 2,000 devices in three years is a steep climb. When asked about the target, Kim Tae-hwan, the company’s chief business officer and head of its European office, stood firm in his belief that the goal is achievable.

“I get why people might question it,” he said. “It sounds aggressive, but we’ve run the numbers. We know the market. It’s not unrealistic.”

The company is targeting annual sales growth of two to three times its current level. Kim emphasized that hitting the 2,000-device milestone would be enough to achieve profitability through cartridge sales alone.

"We’re targeting around 30 tests per day in standard clinical settings," Lim added. "For larger hospitals or specialty centers, that could be 100 to 200."

The company is looking at two key levers: major partnerships and new product launches.

Over the next three years, Noul plans to finalize at least two "high-profile deals" with multinational healthcare companies. Lim declined to give specifics but hinted at long-term discussions with partners Noul has co-developed solutions with and co-authored research papers with for years. Some of those conversations, he said, are already at the contract negotiation stage.

At the same time, Noul is preparing to launch two new diagnostic platforms by the second half of this year.

One is miLab CBC, a cervical cancer screening system designed to help hospitals meet the World Health Organization’s screening targets. The company plans to complete its demo in the first half of this year and begin sales in the second half.

The other is miLab CBC, a next-generation blood diagnostics platform that Lim said could challenge industry norms by enabling finger-prick sampling with just 5 microliters of blood—a fraction of the volume required by conventional systems. This innovation could expand access to testing in pediatric clinics, primary care offices, and retail pharmacies.

Noul positions miLab CER as a cost-effective solution with improved workflow efficiency compared to competing products. Meanwhile, miLab CBC is designed for affordability, with low installation and maintenance costs and no need for specialized personnel, making it more accessible for a broader range of healthcare settings.

The model follows the trajectory of other companies that scaled from startups into global players. Sysmex dominates blood diagnostics. Hologic leads cervical cancer screening. Roche has set the standard in AI-powered automation.

Lim believes Noul can follow a similar path. But hitting break-even is just the first hurdle. Scaling beyond it is the real challenge.

At the press conference, a reporter asked what investors likely wondering: Would Noul consider stock buybacks or dividends?

“Right now, no,” Lim said. The company wasn’t in a position to do that yet. Then he added, "But a higher growth rate could deliver more value than buybacks or dividends ever could."

That was the priority, he explained—reinvesting in expansion, pushing into new markets, and proving that Noul’s technology can compete globally.

He didn’t rule it out in the future. "Once we’re profitable, we’ll look at everything—investments, expansion, shareholder returns. The first step is financial stability. After that, we’ll decide the best way to return value."

Related articles

- Noul secures Thailand FDA approval for AI-based blood analysis and malaria diagnosis solutions

- Noul to showcase AI-based blood and cancer diagnostic platform at CES 2025

- Noul signs supply agreement with Germany's Limbach for AI diagnostics

- Noul secures FDA Class 1 approval for miLab diagnostic solutions

- Noul to supply AI-based blood analysis solution to Italy

- Noul’s blood analysis solution wins medical device license in Korea

- Noul inks supply agreement for AI-backed blood analysis solution in Indonesia

- Noul wins Saudi approval for class 3 AI-backed device to aid malaria diagnosis

- Noul secures $4.7 mil. deal to supply AI malaria diagnostic solution to Benin

- Noul presents AI-powered cervical cancer diagnostic solution at NVIDIA GTC 2025

- Noul to supply AI diagnostics for Kuwait’s upcoming nationwide malaria program

- Noul strengthens global business capabilities with key leadership appointments

- Noul inks $1.1 mil. deal with Nihon Kohden to push AI blood tests across Latin America

- Noul inks $520K Italy deal with TEMA RICERCA to expand AI blood diagnostics