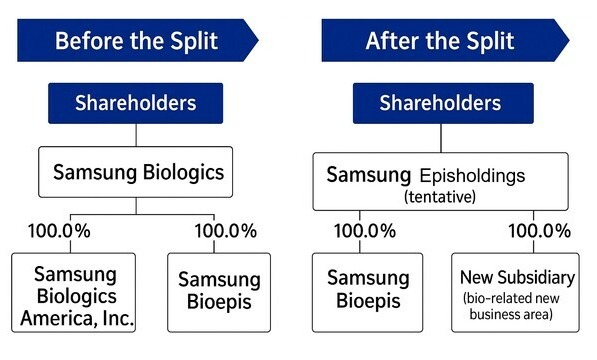

Samsung Biologics on Thursday announced plans to spin off its biosimilar business through a horizontal split, forming a new holding company named Samsung Episholdings, as part of a strategy to sharpen its global competitiveness in both the CDMO and biosimilar markets.

The move marks a structural shift that will separate Samsung Biologics’ CDMO business from its biosimilar arm, currently led by subsidiary Samsung Bioepis.

The company aims to eliminate potential conflicts of interest, enhance operational focus, and increase shareholder value through independent management systems.

With the spin-off, Samsung Biologics will operate solely as a pure-play CDMO, while the newly established Samsung Episholdings will become a dedicated holding company for Samsung Bioepis, which is set to become its wholly owned subsidiary.

The company expects that the separation will allow each entity to accelerate growth and make agile strategic decisions aligned with their respective business domains.

According to Samsung Biologics, the spin-off addresses concerns from global CDMO clients over potential conflicts arising from the company’s concurrent involvement in biosimilar development. It also aims to relieve investors from the burden of simultaneously navigating two businesses with fundamentally different profit structures.

"By creating fully independent corporate structures, both Samsung Biologics and Samsung Episholdings will be better positioned to enhance competitiveness and strengthen their respective corporate and shareholder value,” the company said.

The decision comes amid growing uncertainties in the international trade environment and pharmaceutical pricing policies, which have increased risk exposure for companies operating mixed bio businesses. The split is seen as a preemptive move to de-risk operations and ensure long-term strategic clarity.

Key timeline and shareholder details

The spin-off will follow standard corporate procedures including the submission of a securities registration statement on July 29, followed by a shareholders' meeting scheduled for Sept. 16 to obtain approval. Samsung Episholdings will be officially established on Oct. 1, and will immediately acquire 100 percent ownership of Samsung Bioepis.

The shares of the newly created Samsung Episholdings will be distributed to existing Samsung Biologics shareholders based on a 0.6503913 to 0.3496087 ratio. This ratio was calculated based on the current book value of net assets.

Notably, Samsung Biologics stressed that the spin-off will not dilute shareholder value, as shares in both entities will be distributed proportionally.

Samsung Biologics shares will be temporarily suspended from trading between Sept. 29 and Oct. 28. The relisting of Samsung Biologics, as the surviving entity, and the new listing of Samsung Episholdings will take place on Oct. 29.

Samsung Bioepis CEO Kim Kyung-ah will concurrently serve as CEO of Samsung Episholdings following its establishment.

With the separation, both companies are expected to pursue faster and more specialized decision-making. Samsung Biologics plans to continue its trajectory toward becoming a global top-tier CDMO, focusing on three strategic pillars -- expanding manufacturing capacity, diversifying its service portfolio, and growing its global footprint.

The company also intends to ramp up investment in next-generation businesses, including antibody-drug conjugates (ADCs), adeno-associated virus (AAV) vectors, and pre-filled syringes (PFS), all of which are seen as high-growth segments in the biomanufacturing sector.

Samsung Episholdings, on the other hand, has laid out a vision to develop Samsung Bioepis into the world’s leading biosimilar company. It plans to build a pipeline of more than 20 biosimilar products and invest in next-generation modality platforms to support long-term innovation and competitiveness.

Samsung Episholdings also plans to establish a new subsidiary -- separate from Samsung Bioepis -- to pursue next-generation R&D initiatives, including potential drug development, digital health, or CRO operations, although exact business plans remain undecided.

“This decision reflects our proactive approach to rapidly changing global market dynamics,” Samsung Biologics CEO John Rim said. “By enabling each company to focus on its core strengths, we are paving the way for both entities to build sustainable leadership and drive accelerated growth as global biotech leaders.”

Investor briefing: Strategic rationale and financial impact

During a post-announcement investor briefing on Thursday, Samsung executives elaborated on the reasoning and financial structure behind the split.

Samsung Biologics CFO and Executive Vice President Ryu Seung-ho clarified that although Samsung Biologics had previously implemented strict information firewalls to address concerns about conflict of interest, many global CDMO clients continued to view Bioepis as too closely affiliated, creating barriers to business growth.

"Despite significant efforts, it became evident that we could not fully eliminate client concerns simply through governance mechanisms," Ryu said. “This structural spin-off allows us to ensure strategic clarity and remove any ambiguity in the market.”

According to the company, the combined assets of Samsung Biologics and Bioepis stood at 13.3 trillion won ($9.6 billion) as of the first quarter of 2025. Post-split, Samsung Biologics, the surviving company, will hold 9.9 trillion won in assets, while Samsung Episholdings will hold 3.4 trillion won. Samsung Episholdings will start with virtually no debt, with 3.4 trillion won in equity capital.

Ryu and Samsung Bioepis Executive Vice President Kim Hyoung-joon also detailed long-term growth plans for each company. Samsung Biologics will focus on expanding production capacity, broadening its modality portfolio -- including antibody-drug conjugates (ADCs), adeno-associated virus (AAV) vectors, and pre-filled syringes (PFS) -- and increasing its global footprint.

Currently operating four plants with a total capacity of 604,000 liters, the company recently began operations at Plant 5 and expects to reach 1.32 million liters by 2032. It has also expanded sales offices to Tokyo to tap deeper into the Asian market, following earlier expansions in New Jersey and Boston.

Samsung Episholdings, meanwhile, will focus on advancing Samsung Bioepis as a global biosimilar leader. The company plans to expand its biosimilar pipeline to over 20 products across multiple therapeutic areas, including autoimmune diseases, oncology, ophthalmology, nephrology, and endocrinology.

Kim explained that while biosimilars currently represent just 3 percent of the global biopharmaceutical market, the segment is expected to maintain double-digit growth rates due to increasing regulatory streamlining in major markets.

Samsung Episholdings also aims to launch new subsidiaries focused on next-generation modalities such as ADCs and bispecific antibodies and to engage actively in M&A and venture investments to secure future growth engines.

Clarifying key investor concerns

Executives addressed queries regarding the rationale and timing of the split. Ryu noted that although the 2022 acquisition of full control over Bioepis did not initially raise red flags, the subsidiary’s recent growth had made customer concerns more prominent.

He also reassured shareholders that there will be no capital gains tax or income tax implications due to the spin-off qualifying as a tax-exempt corporate action. Any fractional shares resulting from the split will be bought back at the closing price on the relisting date and reimbursed in cash within five business days.

Regarding questions on whether the move foreshadows broader group-level governance restructuring, Ryu firmly denied such intentions, calling the spin-off a "purely business-driven decision" unrelated to Samsung Group's holding company reforms.

When asked about the potential for Samsung Bioepis to be separately listed in the future, Kim said, “We believe the current restructuring itself is already a major step." At this point, a public listing of Samsung Bioepis is not under consideration as it would only create confusion and contradict the rationale for the current reorganization, he said.

Both Ryu and Kim emphasized that the spin-off will allow investors to selectively back either the stable CDMO business or the high-growth biosimilar development space, depending on their risk appetite.

“This is a structural solution to ensure transparency and operational focus,” Ryu said. “By decoupling the businesses, we eliminate market ambiguity and create investment clarity for shareholders.”

Samsung Biologics reaffirmed that it expects no major changes to its 2025 guidance as a result of the restructuring, and both companies will continue to provide investor updates through regular IR briefings.

Related articles

- Samsung Biologics spotlights high-concentration, early-stage platforms at PEGS Boston

- Samsung Biologics signs $514 million CDMO deal with US pharma company

- Samsung Bioepis operating profit surges 236% in Q1, backed by Europe sales, US biosimilar launches

- Samsung Biologics' operating profit spikes in Q1, driven by plant utilization, FX gains

- Samsung Biologics racks up $320 mil. in 2 new CMO deals

- Samsung Bioepis partners with NIPRO to enter Japanese biosimilar market

- Samsung Biologics inks $75 million CDMO deal with European pharma firm

- Samsung Biologics launches ‘Samsung Organoids’ to expand portfolio beyond CDMO

- Samsung Biologics to showcase ADC CDMO strategy at Interphex Week Tokyo 2025

- Samsung Biologics shareholders approve spin-off to separate CDMO and biosimilar businesses

- Samsung Epis Holdings launched as an investment holding company following spin-off from Samsung Biologics