Over the past year, 33 global pharmaceutical companies conducted 1,600 clinical trials in Korea, investing over 800 billion won ($596.1 million) in research costs. The amount was up 14.3 percent, compared to a year earlier.

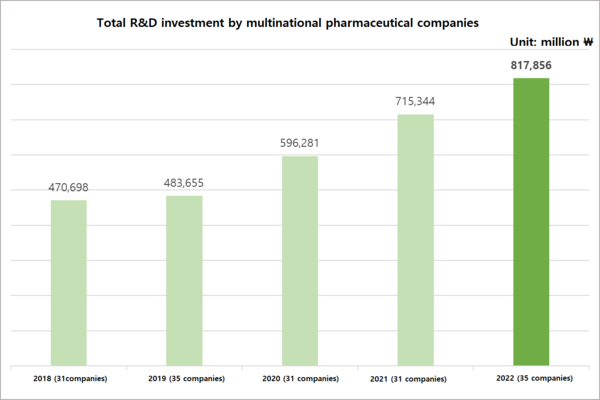

The 14.3 percent R&D growth in 2022 was slower than that of 2021, which stood at 20 percent.

This data was revealed in a report titled "2023 Survey Results on R&D Costs and Research Personnel" released by the Korea Research-based Pharmaceutical Industry Association (KRPIA) on Tuesday.

The report surveyed 33 global pharmaceutical companies operating in the country and highlighted the total R&D investment, workforce, and various clinical research trends of multinational pharmaceutical offshoots in Korea, along with recommendations for regulatory improvements.

According to the survey, the total R&D investment in local clinical research by global pharmaceutical companies, excluding direct R&D investment from overseas headquarters, amounted to about 817.8 billion won in 2022, up 14.37 percent compared to 2021.

The number of clinical trials conducted last year inched up 0.6 percent compared to the previous year, totaling 1,600.

"Despite a global decline in the number of registered clinical trials and approvals for domestic clinical trials, the R&D investment of multinational pharmaceutical companies in Korea has consistently increased," KRPIA said. "The commitment of global pharmaceuticals to clinical research in Korea has enhanced patients' access to innovative drugs."

The report estimated the cost of clinical trial drugs provided to Korean patients by global pharmaceutical companies last year at around 344.9 billion won.

The KRPIA's data also outlined that a consistent increase in the number of phase 1-3 clinical trials from 2018 to 2022 has been observed.

"Early-stage clinical trials, such as phase 1 and 2 studies, in 2022 recorded high annual growth rates of 14.5 percent and 9.4 percent compared to 2021, respectively, suggesting faster access to innovative treatments for Korean patients," a KRPIA official said.

KRPIA also emphasized the continued investment in severe and rare diseases by global pharmaceutical companies.

"A survey on major clinical studies conducted in Korea showed that cancer research accounted for the most trials with approximately 76 percent, followed by rare diseases (11.8 percent)," KRPIA said. "The average annual growth rate of clinical trials over the past five years also displayed significant growth for cancer research (14.7 percent) and rare disease research (25.6 percent)."

The association added that the research investment by global pharmaceutical companies has also contributed to the growth of the domestic pharmaceutical industry and the creation of skilled professionals in the country.

"The number of professionals involved in R&D activities of the surveyed companies last year was recorded at 2,055, showing a steady increase since 2018," KRPIA said. "Korea, which ranked fifth in the global clinical trial registration count last year, is recognized for its competitiveness in the pharmaceutical and R&D sectors."

Given the technological advancements accelerated by the Covid-19 pandemic, there's a need for proactive support from regulatory authorities to ensure that advanced clinical trials are conducted properly in Korea, it added.

KRPIA also pointed out that while clinical trials in Korea continue to grow, the country lags in the timely introduction of new drugs.

"According to recent research, after a new drug is initially released globally, Korea's introduction rate within the first year is a mere 5 percent, which is only a quarter of the OECD’s average of 18 percent," KRPIA said. "Considering Korea's elevated status in the global pharmaceutical and biotech market and various regulatory innovation efforts, there's an urgent need for regulatory and policy improvements to enhance treatment accessibility for Korean patients."

Related articles

- Korea’s drug approval too slow, compared to U.S., Europe: KRPIA

- Korea to exclude Australia from new drug pricing reference country list

- KRPIA raises concerns over Korea's plan to add Australia to drug pricing reference country list

- 31 multinational drug companies increased R&D in Korea by 20% in 2021: KRPIA

- Sanofi-Aventis Korea GM elected as new chairperson of KRPIA