In the midst of growing interest in ribonucleic acid (RNA)-based therapies, such as Spinraza (sodium nusinersenate) for spinal muscular atrophy (SMA) and the messenger ribonucleic acid (mRNA) Covid-19 vaccine, a Korean company is trying to become the industry's No. 1 contract manufacturing organization (CMO) by developing RNA therapies.

ST Pharm, an affiliate of Dong-A Socio Group, is the company that produces oligonucleotides, the core raw materials for RNA therapeutics.

Originally producing raw materials for synthetic drugs, the company has been focusing on expanding its oligo production capacity in recent years.

The company broke ground in September to begin the construction of its Second Oligo Plant in the Banwol Campus, Gyeonggi Province. Upon completion of the second Oligo Plant, ST Pharm’s production capacity will increase from 6.4mol/year to 14mol/year by 2026.

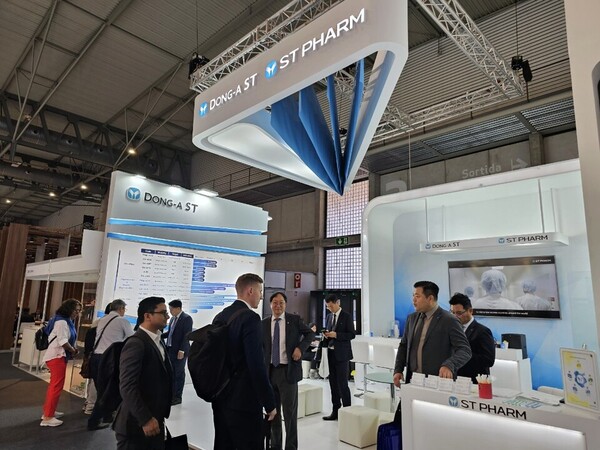

Last month, ST Pharm participated in the World Pharmaceutical & Bio Exhibition (CPHI Worldwide 2023) in Barcelona, Spain, and ran a booth with Dong-A ST. Dong-A Socio Holdings President Jung Jae-hoon and Dong-A ST R&D General Manager Park Jae-hong attended the event, showing their support on the group level.

Korea Biomedical Review met with ST Pharm CEO Kim Kyung-jin to learn about the competitiveness, market outlook, and future business plans of ST Pharm as an oligo CMO.

Asked about the purpose and expectations of participating in the event, Kim said, "In addition to receiving additional orders from existing customers, the goal is to find new customers. We need to receive orders for the volume to be produced in the 2nd Oligo Plant to start discussions next year and produce the volume in time for its completion in 2025."

Regarding the plan to build the second plant, Kim said, "Once it is completed in 2025, we aim to start operating it in 2026. Currently, ST Pharm's oligo production capacity ranks second or third in the world. We expect to move to the top once the second oligo building is completed. We aim to become the number one in nucleic acid therapeutics, just as Samsung Biologics has become the number one in biopharmaceutical capacity."

He went on to say, "Currently, there are only a few companies worldwide that can make raw materials for nucleic acid therapeutics. Chinese and Indian companies are attempting to enter the field, but the technical barriers to entry are higher than for synthetic drugs. It will take about five years for these companies to enter the market. ST Pharm will seek the so-called 'super-gap' strategy, and we are trying to widen the gap."

Regarding the outlook for the company's sales and operating profit, Kim said, "We are making large-scale investments to expand production facilities, so it may be difficult to see (a significant increase) this and next year. However, once the second oligo building is completed, it will be a great help to sales and operating profits.”

Kim added that he believes that the U.S. Food and Drug Administration (FDA) is scheduled to conduct many PAI (Pre Approval Inspection) for customer orders next year, leading to production expansion and sales as products are commercialized.

In addition to oligo production, CEO Kim also revealed the status of the mRNA vaccine CDMO (contract development and manufacturing) business.

"It is not a large amount, but we have about 10 pipeline orders and are producing. Most mRNA vaccine developments, except for Moderna vaccines, are in non-clinical or phase 1,” he said. "It will take some time to enter the subsequent phases, but the mRNA CDMO market will improve when they enter phases 2 and 3."

Kim emphasized the importance of adopting a quality-by-design (QbD) system in the CMO and CDMO business, sharing an anecdote from his job interview and pointing out that some Korean pharmaceutical companies have not internalized basic competencies in QbD.

"A team leader from a well-known Korean pharmaceutical company came to us for an interview, but when asked about QbD, he couldn't answer the question. I was surprised," he said. "If you're a team leader in a company like that, you should have the concept of QbD and be able to set up a strategy."

However, Kim was optimistic about drug development in the Korean biopharma industry, citing the changed landscape of CPHI.

"Just 10 years ago, it was difficult to find Korean companies, but CMOs and CDMOs are gradually coming in, and biopharmaceuticals can be seen at the event, which used to focus on synthetic drugs," Kim said.

He went on to say, "It's been about 10 years since the Korean pharmaceutical industry started to develop new drugs in earnest with the export of Hanmi Pharmaceutical's technology, and we're talking more and more about production, quality control, and commercialization strategies. The bio-ecosystem needs to experience an overall uptick."