Major global pharmaceutical companies are introducing decentralized clinical trials (DCT) to reduce the drug development period, cut costs, and improve patient access to clinical trials.

However, Korea has yet to come up with a related regulatory regime, making the nation’s status disadvantageous as a participant in global clinical trials and resulting in a delay in introducing new drugs, according to concerned industry experts.

In a recent Bayer Pharma Media Day 2023, the multinational company also said it is making the most of DCO to develop its portfolios.

The purpose is to cooperate with partners and allow patients to participate in clinical trials more easily while enhancing diversification by lowering barriers to different demographic groups through DCT.

“Bayer’s portfolio is based on up-to-date digital technology improved through new data and patient-oriented decentralized clinical trials,” said Christoph Koenen, senior vice president and head of Clinical Development & Operations, Pharmaceutical Division, and Pharma R&D, Bayer. “Such innovation will eventually expand patients’ access to clinical trials.”

He explained that Bayer is taking a mixed approach, in which the company does not entirely rely on DCT but mixes them with conventional clinical trials, adding that it is because various governments have different regulations in permitting DCT.

Koenen predicted that countries like Korea, which maintains a conservative position on DCT, will ultimately turn toward an open stance.

“If DCT is used more worldwide gradually, regulatory agencies will also understand the levels of data created by DCT are as high as those produced by traditional clinical trials,” he said. “If that happens, I expect the Korean regulators’ positions on DCT to turn more favorable, too.”

Bayer is not the only multinational pharma that has used DCT to develop new drugs. Other Big Pharma companies, such as GSK, AstraZeneca, Novartis, Pfizer, and Sanofi, have already been using DCT to develop their portfolios.

Companies in North America are most vigorously carrying out DCT, but other regions, including Asia-Pacific, Middle East, Africa, and Latin America, are also active in its use. The relevant fields are also diversifying, including the central nervous system, metabolic disorder, infection, respiratory system, tumor, and cardiovascular diseases.

In addition, the Covid-19 pandemic has sped up global pharma’s benefitting from DCT.

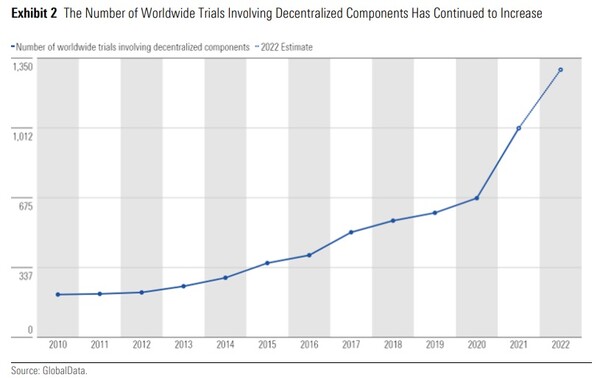

For instance, the number of DCTs stood at 207 worldwide in 2010, but the number increased to 1,011 in 2021 (refer to the graphic), and the upward trend will continue in the future, according to industry experts.

Regulators in various countries also moved actively to manage and support DCT, which drastically increased during the pandemic by, for instance, setting up guidelines.

In collaboration with contract research organizations and clinical trial sponsors, the U.S. Food and Drug Administration and other global regulatory agencies assessed DCT’s advantages and problems before determining standards for remote trials. In 2020, the FDA announced guidelines on clinical trials during the Covid-19 public health emergency period.

In December 2021, FDA also unveiled a draft guideline titled “Digital Health Technologies for Remote Data Acquisition in Clinical Investigations.”

However, Korea has yet to make regulatory rules on DCT. Moreover, experts point out that due to the Korean government’s viewpoint that regards clinical trials not as “research” but as “treatment,” it will not be easy to introduce DCT here.

The problem is the later the nation introduces DCT, the higher the likelihood it will be excluded from countries participating in global clinical trials, as DCT has already become a global trend.

may eventually lead to a delay in introducing new drugs. Usually, the Ministry of Food and Drug Safety first checks whether Korea participated in the landmark clinical trials of the drugs in question (whether there are Korean data) in reviewing them for approval.

To the relief of the industry, the government has taken its first step toward introducing DCT.

In the “Implementation plan for medicine products’ safety management” announced last month, the food and drug safety ministry said it would take a new approach to some elements of clinical trials, including collecting clinical data using wearables or mobile devices. In other words, the ministry has just rolled up its sleeves to work out DCT-related regulations.

Also, according to the government’s comprehensive plan to support the biopharmaceutical industry, it aims to rank third in global clinical trials by 2027 (from sixth in 2021) and is making detailed programs to foster DCT specialists.

“To nurture full-cycle experts equipped with clinical trials’ practical capabilities, we will foster talents in each stage of clinical trials, such as intermediary clinical trials, early and later trials, and overseas approval, while those in new areas, such as decentralized clinical trials,” the government said in the plan.

Related articles

- [Special] ‘Regulation’ blocks DCT introduction in Korea. So how to unravel tangled threads?

- [Special] DCT was behind 1st Covid-19 vaccine developed in just 1 year

- [Special] 'Be it US, Europe, or China, DCT is global trend in clinical trials'

- [Special] Decentralized clinical trial is not an option but a must

- Clinical trials are shifting towards DCT but hybrid approach more likely: IQVIA execs

- Regulator ‘half-positive’ to digital healthcare firms' request to introduce DCTs

- JNP MEDI's pioneering role in DCT unveils enormous potential

- Korea's delay in decentralized clinical trials sparks global exclusion concerns: experts