Despite Korean biopharmaceutical companies’ sales growth by 20 percent on-year in the first half, their stock prices plunged, resulting in a significant loss in their market capitalizations.

According to the Electronic Disclosure System of the Korea Exchange, the total sales of the top 25 biopharmaceutical companies in the first half of this year were about 11.3 trillion won ($8.2 billion), up 20.2 percent from 9.4 trillion won in the same period last year.

Operating profit also increased by 29.5 percent to about 1.8 trillion won compared to the same period last year.

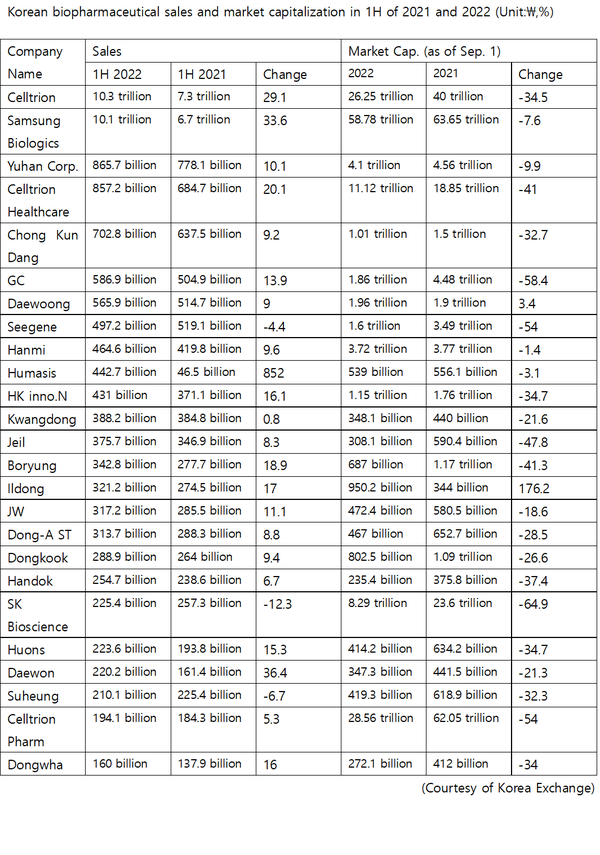

Celltrion recorded the highest sales in the first half with 1.366 trillion won, followed by Samsung Biologics (1.15 trillion won), Yuhan Corp. (865.7 billion won), Celltrion Healthcare (857.2 billion won), Chong Kun Dang (702.8 billion won), GC (586.9 billion won), Daewoong Pharmaceutical (565.9 billion won), Seegene (497.2 billion won), Hanmi Pharmaceutical (464.6 billion won), and Humasis (442.7 billion won).

However, their combined market caps shrunk significantly due to the bearish biopharma stock market since last year.

The combined market caps of the top 25 companies by sales in the first half of this year was 129.95 trillion won as of Sep. 1, down 52.76 trillion won (29 percent) from the same period last year (181.77 trillion won).

The company with the largest drop was SK Bioscience, which shrank 64.9 percent from 23.06 trillion won in the first half of last year to 8.29 trillion won in the same period of this year.

SK Bioscience's sales and operating profit in the first half of this year were 225.4 billion won and 84.9 billion won, down 12.4 and 29.1 percent, respectively, from the same period last year.

Other companies that saw a rapid decline in market caps by more than 10 percent included Seegene (3.493 trillion won to 1.606 trillion won), Celltrion Pharm (6.205 trillion won to 2.856 trillion won), Jeil Pharmaceutical (590.4 billion won to 308.1 billion won), Boryung (1.171 trillion won → 687 billion won), and Celltrion Healthcare (18.85 trillion won to 11.124 trillion won).

Companies with a relatively small decline in market cap (10 percent or less) included Samsung Biologics (63.65 trillion to 58.78 trillion), Yuhan Corp. (4.562 trillion won to 4.108 trillion won), and Hanmi Pharmaceutical (3.774 trillion won to 3.72 trillion won) and Humasis (556.1 billion → 539 billion won).

Of the 25 companies, only two witnessed a growth in market cap -- Daewoong Pharmaceutical and Ildong Pharmaceutical.

Daewoong and Ildong Pharmaceutical recorded a market cap of 1.96 trillion won and 950.2 billion won, up 3.4 percent and 176.2 percent from the previous year, respectively.

Lee Jun-soo, an analyst for Prophet Asset Management, said Ildong Pharmaceutical's drastic surge in market cap stemmed from a possible launch of Xocova, an oral Covid-19 treatment that is being developed jointly with Japan's Shionogi Pharmaceutical.